最近在上海举行的中国国际进口博览会(CIIE)在西方媒体上鲜有关注,但更提醒我们的是,中国是一个超越美国的经济和贸易大国。 是的,这个词是“超越”。 CIIE还可以提醒我们,中国的经济实力目前站在四个强大的支柱上。

美国人必须清楚地了解这一点,因为最终所有力量都从经济力量中脱颖而出,包括军事力量。 因此,在许多方面,对中国采取对抗方法都是极其危险的,几乎所有执政的精英都敦促我们采取对策。 这种对抗的后果与对委内瑞拉,玻利维亚,叙利亚,伊拉克,阿富汗甚至俄罗斯的侵略有很大不同。 正如亨利·基辛格(Henry Kissinger)最近警告我们的那样,如果不理解中国的实力可能会给美国乃至世界乃至整个世界造成致命的灾难。

这篇简短的文章是为防止此类灾难做出的一小部分贡献。 它提供了一个缩略图,是中国经济四分法的入门书,它是四个支柱,可以用来衡量中国的力量以及它如何基于该力量与世界互动。 这四个是:1,按购买力平价计算的国内生产总值; 2,出口; 3,进口; 4,内部零售市场。 在每种情况下,我们都将它们与美国进行比较。有很多预测都预言了几十年来中国经济即将解体,但没有一个能成为现实。 因此,让我们完成预测并集中精力于我们在我们之前观察到的内容。 本着这种精神,本文主要是对目前存在的冷酷事实进行回顾。 它是由非经济学家撰写的,这是它给世界带来真实感的原因之一,因为它提供了许多假设,模型和大多数是如意算盘的想法,而不是可能或可能不会出现。 亲爱的读者,我希望它不会损害您的智力。 它只是介绍,希望也可以唤醒我们这个世界的现实。

1,按购买力平价计算,中国拥有世界上最大的GDP,自2014年XNUMX月以来一直如此。

在我们要考虑的四个经济支柱中,第一个也是最基本的是从其国内生产总值(GDP)看其经济规模。 在这里,传统观点认为中国是GDP的第二名-但令大多数人惊讶的是,实际上它是第一名。 以购买力平价(PPP)计,中国目前是世界上最大的GDP。IMF,世界银行甚至CIA都使用这种度量标准来比较不同国家的GDP。 因此,这是不被轻描淡写或根本不被解雇的措施。 IMF提供了最新数据(2019年XNUMX月提供),提供了中国和美国的PPP-GDP,因此:

中国,27.3 万亿美元 美国,21.4 万亿美元

(中国的数字不包括中国城市香港,其 PPP-GDP 为 0.491 万亿美元或澳门为 0.078 万亿美元。这两个使中国的总额达到 27.9 亿美元。)

现在,让我们考虑一下什么是PPP指标,以了解为什么它是比较国内生产总值最有意义的方法。 简而言之,购买力平价的计算可以校正名义GDP,即任何国家的美元GDP。 名义GDP可以简单地通过使用当前货币汇率以美元而不是本国货币(例如人民币)来表示一个国家的GDP来计算。 购买力平价名义GDP的PPP校正给出了给定国家的实际购买能力或总GDP的购买力的量度。 让我们来 一个[假设的]例子 了解这一点。 【假设】127年中国生产了价值2017万亿元人民币的商品和服务。按6.37元兑美元汇率计算,相当于11.97万亿美元。 那就是中国的名义GDP。 当年美国国内生产总值为 19.36 万亿美元。 这些价值11.97万亿美元和19.46万亿美元被指定为两国的“名义GDP”,也是我们在主流媒体上看到的大部分价值。

但现在让我们假设两国生产的唯一商品或服务是巨无霸。 2017 年,巨无霸在中国的价格约为 3.17 美元,但在美国使用人民币兑美元的标准汇率为 5.28 美元。 因此,巨无霸在中国更便宜——出于各种原因,包括不同的原料、劳动力、运输成本等。因此,本例中美国/中国的“巨无霸购买力平价”比率为 5.28/3.17 或 1.67。 现在,我们可以通过将该比率应用于中国名义 GDP 来以购买力平价计算 GDP。 美国的新价值为 19.36 万亿美元,不变,中国为 19.93 万亿美元(即 11.97 万亿美元乘以 1.67)。 现在,以购买力平价计算,中国的 GDP 是两者中较大的一个。 国际货币基金组织、世界银行和中央情报局世界概况所使用的实际购买力平价比率当然不限于巨无霸,而是使用商品和服务的“篮子”来计算购买力平价比率。 那个篮子里有火箭和汉堡,工厂工人和技术工人的工资以及麦当劳工人的工资,工厂机器人和汉堡烤箱。 购买力平价-GDP 告诉我们可用的购买力比仅基于简单汇率(即名义 GDP)所能识别的要多得多。 (其实有个巨无霸PPP指数原来是建议的 “经济学家” 几年前作为漫画设备使用,但由于Big Mac的配方和成分在世界范围内完全相同,因此它可以提供一些粗略的定性信息。 普遍性是巨无霸的一个特征,许多宗教都宣称具有同样的品质,并且具有西方价值观。 PPP度量标准是衡量经济实力的重要指标,因为它告诉我们实际可以购买的东西–货币是没有意义的,除非并且直到它实际购买某种东西为止。

根据国际货币基金组织(IMF)的数据,使用PPP指标,中国的GDP在2014年XNUMX月超过了美国。 今天约占美国PPP GDP的130%,根据上面给出的IMF的2019年价值。 但是,美国和中国政府经常在公开声明中使用名义GDP,而今天的中国GDP就是今天 约66%的美国 GDP。 有人怀疑这一公约满足了中国政府不惊动美国的愿望,也满足了美国政府在所有事情上都排在第一位的愿望。 但是除非有一些不可预见的灾难,否则名义GDP将很快重蹈覆辙。 根据我的粗略估算,中国的名义GDP将在15年后超过美国。 但这只是一个预测,我们希望尽可能避免使用它们。 在这里,我们希望强调已经存在的PPP-GDP。 西方主流媒体也使用中国和美国的名义GDP进行比较,很少提及PPP-GDP。 因此,很少有人意识到后者就不足为奇了。

此外,即使以目前“缓慢”的速度(约6%),中国的GDP增长速度也要比美国(约2.0%)快得多。 没有迹象表明中国的国内生产总值将回落至第二位,也没有可靠的预测会这样做。 如此庞大且快速增长的GDP是中国经济实力的基本支柱。

最后,即使中国拥有世界上最大的 毛 PPP-GDP,它仍然是一个发展中国家。 现在无论贫富。 拥有近1.4亿人口, 人均 名义GDP约为美国的四分之一。中国在集体力量方面富有,但在个人收入方面相对较差。 因此,如果要实现到 2049 年(即建国一百周年)将大部分人民纳入中产阶级的既定目标,中国需要进一步发展经济。 然而,国民经济实力取决于经济总量而非人均产出。 如果 1 亿人每人贡献 100 美分或 100 亿人每人贡献 XNUMX 美元,则最终结果足以购买例如 XNUMX 亿美元的卫星发射基地。 对于国力来说,更多的时候,总数才是最重要的。

通常,PPP指标仅用于GDP。 以下各节中的所有值仅基于汇率,没有进一步的更正。

2.中国是世界第一大出口国。

中国经济实力的第二大支柱是其作为世界最大出口国的着名地位。 这里令人惊讶的是,中国遥遥领先,但没有像我们经常被告知的那样,中国因在国际贸易中“利用美国”而受到谴责。 根据 联合国最新数字,2018年,美国和中国的商品出口额以万亿美元计如下:

货物出口(2018):

中国,2.5 万亿美元 美国,1.7 万亿美元

(中国的这个数字不包括出口额为 0.6 万亿美元的香港,这一数字使出口总额达到 3.1 万亿美元。)

但是,这些数字(通常给出的数字)不包括服务出口,与美国相比,服务出口对美国总出口的贡献要大得多。

服务出口(2018)

在2018年,美国无疑是世界上最大的服务出口国,而中国则落后于美国,英国,德国和法国,成为世界上最大的服务出口国。 第五大服务出口商。 在2014年至2018年期间,中国的服务出口 比6%增长了11% 在服务出口方面,中国表现出一定的弱点,这可能是由于其与西方的语言和文化距离更大。 以印度为例,尽管在服务出口中排名第六,但在6-30年期间增长了2014%。

对于那些对哪些服务出口感到好奇的人,发现了一些来自中国的主要服务 点击此处 并离开美国 点击此处。 由于美国主要是服务经济体,因此服务应占其出口总额的三分之一就不足为奇了。 服务出口可能比制造出口产品提供更好的就业机会。 例如,服务出口的一种类型是外国人来美国并付费上学时的教育。 培养更多的教授或更多的汽车工人会更好吗? 哪个可以提供更好的收入和更好的生活质量? 我认为中国在这一领域的相对较差的表现无疑是一个弱点,部分原因是中国经济的发展水平,部分原因是中国的软实力较低,而且与西方的语言和文化距离较远。

货物和服务出口总额(2018)

中国,2.7 万亿美元 美国,2.5 万亿美元

尽管如此,中国还是出口第一大国,其出口增长已被证明具有显着的弹性。 根据 9年22月2018日的金融时报):“在 2009 年超过德国成为世界最大的商品出口国后,中国出口额以年均 5% 的速度增长,到 2.26 年达到 2017 亿美元,而全球出口年增长率低于 2%。 在过去十年中,中国在制造业出口中的份额从 18% 扩大到 12%,这增加了中国 2001 年加入 WTO 后加速发达国家制造业就业下降的成果。”

英国《金融时报》在同一篇非常有启发性的文章中还指出,尽管像华为这样的公司将全球注意力集中在中国发展高科技产品上,但中国出口的快速增长一直是“中等水平的技术,例如车辆及其制造技术”。零件,电机和工程机械。” 英国《金融时报》说“根据美国国家科学委员会的数据,中国现在是中高科技产业的主要生产国,在过去十年中,其全球份额几乎翻了三倍,达到32%,在2000年代后期和美国都超过了这个十年。”

此外,中国48%的产品出口到OECD(经济合作与发展组织)发达国家之外的国家 根据《金融时报》。 这减轻了美国及其欧洲半附庸国对中国的影响,并提供了中国与(以及您刚才说过的中国向不发达国家的出口)与发展中国家之间的各种联系。 中国似乎远远不仅仅依靠美国市场和其他西方市场来消费其产品。.

中国现在显示出决心,将其价值链进一步向上转移到高科技领域,并于2015年通过“中国制造2025“十年计划”的灵感来自德国 工业4.0。 正是官方而不是一带一路倡议使华盛顿屈服了。 该计划已经很好地进行了,以Huwei的5G技术为例,并已成长为智能手机销量的第三名。 但是,在本文中,我们试图尽可能多地谈论当前的现实,而中国仅处于高科技生产和出口的门槛。 但是,让我们从 故事中的《日经亚洲评论》 题为“中国存储芯片的产量从零增长到世界总量的5%:随着北京为技术自给自足而发动的大规模生产将在2020年开始。” 开幕式上写道:“台北-北京在技术上实现自给自足的努力正处于重大突破的边缘,该国新生的芯片产业有望在5年底之前从几乎为零的生产到全球2020%的存储芯片今年,熟悉此事的消息人士告诉《日经亚洲评论》。 美国对存储芯片和其他电子商品的限制显然正在推动中国变得自给自足,从而成为美国和其他发达国家在世界市场上的竞争者。 有人会问美国在切断中国对美国电子产品的进口方面是否表现得很明智。 很难看出这对美国国际收支的帮助远不及美国芯片制造商和其他电子设备制造商的未来市场份额。 美国对“安全”的担忧是真实的还是仅仅是保护主义的另一种形式?

3.中国是世界第二大进口国,拥有第二大零售市场和最大的电子零售市场–上海的CIIE。

中国作为进口国的迅速崛起并不像其作为出口国的角色那样广为人知。 然而,在2019年XNUMX月,第二届上海中国国际进口博览会(CIIE)吸引了全世界的目光。 来自世界各地的商人和政府官员来到上海,向中国进口商推介他们的商品,以迎接蓬勃发展的中国内部市场。 (回想一下中国经济三合会的第一个分支,那就是不断增长的中国经济,其工资和薪水不断增长,产生了对产品的巨大需求。)也许最著名的贵族是法国总统马克龙,他敦促法国葡萄酒和其他商品的进口中国进口商,葡萄酒商人和饭店主。 他甚至诱使习近平品尝了他们共同烘烤的高卢葡萄。 习近平当然在吹捧,还有其他“开放”的演讲。 和 提醒游客说,开放包括为全球出口商出售给中国的欢迎垫。

进口量 可提供值的最新年份2018年的商品数量是:

中国,2.1 万亿美元 美国,2.6 万亿美元

服务进口(2018):

中国, 0.5 万亿美元, 0.6 万亿美元

货物和服务进口总额(2018年):

中国, 2.6 万亿美元, 3.2 万亿美元

此外,中国的进口额现在正接近其商品和服务出口额(2.7 万亿美元,见上文),进口增长速度几乎是出口的两倍。 如果这种趋势像极有可能的那样继续下去,中国的正贸易顺差应该会减少,从而使其进出口更加平衡,并消除对其在世界上出口实力的一些担忧。 更明确地说,中国不断增长的进口为缓解推动特朗普式对华贸易战的贸易失衡提供了基础。 如果从美国出口的产品和中国目前的需求来看,这种匹配是相当不错的。 中国需要农业和高科技产品。 切断中国与其中任何一个的联系,它就会找到其他来源,就像它的农产品一样,或者自己发明和制造,例如用于电子设备的芯片。 我们可能会问,这对美国来说是不是一个明智的策略?

4.中国的零售市场与美国大致相当,并且增长速度更快。

进口的增长是中国购买力增强的迹象之一。 另一个是中国零售市场的飞速增长,现在已经几乎达到了美国零售市场的规模。

中国,5.2 万亿美元 美国,5.3 万亿美元

中国零售市场的蓬勃发展是由于其不断扩大的中产阶级的增长所致。 正如eMarketer的高级预测总监Monica Peart所说, 把它,“近年来,中国的消费者收入不断增长,成千上万的人涌入了新的中产阶级。 结果是人均购买力和平均支出明显增加。” 中国的电子零售市场更加引人注目,它已经成为世界上最大的电子零售市场。 再次eMarketer,“到目前为止,中国是全球最大的电子商务市场,是美国电子商务市场规模的三倍以上。 中国在全球电子商务销售额中占54.7%的份额,而美国仅占16.6%。” 这也不足为奇,因为随着已经在中国进行得很好的5G的推出,中国人已经变得非常精通技术,并与互联网紧密相连,并且链接之间的联系越来越紧密。

考虑到中国市场的规模及其持续增长,几乎没有一家大公司比被美国市场拒之门外。 不仅是公司,而且它们所居住的国家都必须考虑到这一点。 这给中国带来了巨大的影响力,这种影响力是建立在人民的日益繁荣上,而不是建立在人民的牺牲上。 此外,尽管中国的中产阶级大约有300亿,大约相当于美国总人口的数量,但它却有1.4亿人口,并且它计划到2049年将几乎所有这些人都带入中产阶级,以迎接百年华诞。新中国成立之初

这种经济的巨大力量将使中国成为世界上没有经济同行的大国。 而且这似乎是不可逆的。 除非发生太平洋全面战争的前景。 但这是为了将来,不在本文的讨论范围之内。 即使在最简单的系统中,预测也是危险的。 中国的现状足以证明它应该是合作的对象而不是冲突。

中国的三合会-核武器。

如果在讨论中国的经济四分体系之后,我们也没有提及中国的核武器三合会,那我们将不为所动。 1月在上海举行的CIIE会议之前的一个月是70月XNUMX日在北京举行的中国国庆游行,庆祝XNUMX周年。th 新中国成立十周年。 展出的是中国的核威慑力量:陆基洲际弹道导弹(洲际弹道导弹),潜射弹道导弹和空中发射武器的三合会。新型先进的洲际弹道导弹首次亮相,提供了中国核三合会的证据。是 现在已经完全开发。 简而言之,像俄罗斯和美国一样,中国现在可以摧毁任何试图对其发动战争的国家。

但是中国核威慑的几个特点值得关注。 正如香港《南华早报》告诉我们的那样:“按照其“最小威慑”战略,目前的中国核武库估计约为250枚弹头,该国对核导弹采取了“不首先使用”的原则……。总部位于北京的军事评论员周晨鸣说,“中国不需要保留太多的核弹头,只需让远程导弹配备昂贵的核弹头,因为这足以进行核威慑。”与俄罗斯或美国不同,中国没有数千枚核弹头,与美国不同,中国已经“抛弃”了“首次使用”核武器。 中国具有强大的威慑力,但现在不构成进攻威胁。

结论。

我们如何看待中国的这种经济和军事力量? 总之,中国是一个强大的经济大国,无法摧毁,对美国或任何其他国家也没有进攻姿态。 美国该怎么办? 答案不是很明显吗?事实上,鉴于两国的相对实力,这是不可避免的吗? 现在是时候制定一种和平的安排,使我们能够共同生活。 美国应该在可能的时候和在灾难发生之前这样做。 偶然战争核战争席卷了我们所有人。 时钟在滴答作响。

可以通过以下方式与约翰·沃尔什(John V.Walsh)联系: [电子邮件保护]。 他为Antiwar.com,Consortium News,Dissident Voice.org和其他媒体撰写有关战争,和平与帝国以及医疗保健的文章。 现在住在东湾,直到最近他还是麻省医学院的生理学和细胞神经科学教授。

RSS

RSS

中国的债务不是GDP的4倍吗? 听起来很吓人。

我觉得奇怪的是美国白人多么热情地捍卫“他们的”国家,考虑到它由犹太人和黑人主宰,他们是其中的二等公民,而且年复一年地变得越来越如此。

然而尽管如此,他们中的大多数人仍然有一个天真的“美国! 美国! 美国!” 这种心态,即使是很多本该更了解的美国白人,比如自称“民族民族主义者”的人,仍然经常有这种心态。 你不会在欧洲的民族主义者中发现这种心态,欧洲民族主义者在支持国家方面的投入远不及美国人,事实上大多数欧洲民族主义者坦率地说,毫无疑问地将国家视为敌人。

一个错字:根据中国政府统计局的数据,中国 2017 年的 GDP 是 82.7 万亿元,而不是 127 万亿元

购买力平价 GDP 可能非常不准确,因为它没有考虑消费模式。

一些例子:

1)人们越穷,家庭预算中花费在食品上的比例就越大,美国农民的大宗食品生产成本(玉米和大豆就是很好的例子)因为机械化程度更高。 中国的消费电脑硬件似乎也不便宜。

2) 据说印度购买力平价 GDP 为 11 万亿美元。 印度不可能拥有美国一半的经济实力。

我曾经从一个印度民族主义网站上读到,在美国理发的费用是在印度的 24 倍。 抛开顾客的服务质量和服务经验,告诉我一个贫穷的印度理发师用他/她微薄的收入可以买多少散装食品?

这是一个 4 分钟的精彩视频,向美国人解释了这些基础知识:

官方数字可能看起来不错,但是有各种各样的问题使这些政府赞助的价值观看起来很神秘。

_____

中国存在比美国更严重的“泵启动”问题:(1)

____

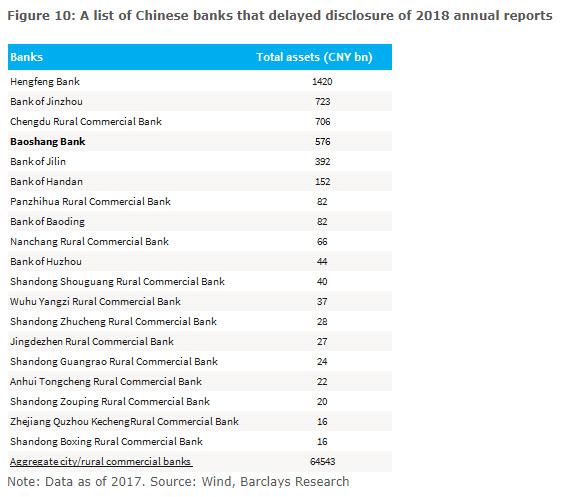

中国有一个迫在眉睫的银行倒闭问题:(2)

.

______

此外,考虑美国正在结束(或至少减少)中国在货币估值和贸易安排方面的剥削这一事实。 随着谈判的继续,这是一个不断变化的目标,但严肃的分析师相信,这将减缓中国经济的某些部分。

和平😇

_______

(1) https://www.zerohedge.com/geopolitical/end-chinese-miracle

(2) https://www.zerohedge.com/news/2019-05-30/which-chinese-banks-will-fail-next

关于亨利基辛格的一句话。

我记得当国会“辩论”中国最惠国待遇时。 在《纽约时报》的社论中,亨利·基辛格坚持认为,将我们的整个工业基地运送到共产主义中国将是美妙而伟大的,而且不可能有任何不利因素。

当然,《纽约时报》的这些社论从来没有提到他被共产主义中国支付了数百万美元(通过“Kissinger Associates”洗钱)。

不管人们怎么想这一切,请记住亨利·基辛格是他的国家的叛徒。

“因为最终所有的权力都来自经济权力”

那么,美国将经济基础输出到中国的原因可能是什么?

“根据中国政府统计局”

好吧,那是一个真正的面对面时刻。 如果中国像美国一样,那么大多数“统计数据”都是虚构的……例如通货膨胀率和失业率。

“名义 GDP 的计算方法很简单,就是用当前的货币汇率以美元表示一个国家的 GDP”

这些中国是宇宙大师的文章总是在他们自己的指标中争论同样的事情…………当中国将他们的货币与美元挂钩时,这个指标有什么关系? 他们可以组成任何他们想要获得任何他们想要的 PPP 级别的交易所…………..这一切看起来都太荒谬了。

另外,我注意到“中国奇迹”的文章总是在最高点时进入高速档……恕我直言。

与中国达成贸易协议是美国最不需要的。 我们需要与中国彻底脱钩,越快越好。 我们需要生产更多我们消费的东西,他们需要消费更多他们生产的东西。 带回我们的制造业,恢复中心地带的工作。 农业部门几乎完全由 4 家跨国公司拥有,这些公司雇佣了最多的非法移民,并将他们全部送回家。 最好是创造更多的工厂工作岗位,并让那些因绝望而自杀和成群结队地吸食阿片类药物的“可怜人”就业。

印度也是如此——他们的整个服务业都是建立在美国外包的基础上的。 是时候结束肉汁列车了。 结束 H1b 签证,让这些水蛭打包、雇佣和培训我们自己的公民。

扣除美国政府债务和军费后,美国 GDP 只有 8 万亿。 在生产方面只有 8 万亿美元。

无论如何,有人看过新的乌克兰飞机失事视频吗? 它的大屠杀。 2 次射击,第 30 次和击杀之间有 1 秒的暂停。

大屠杀

自动化即将到来。

无论哪个国家更好地应对即将到来的工业革命 4.0,都将统治本世纪剩下的一切。

中国在地理上似乎非常脆弱。 随着几座水坝的破坏,大部分工业基础和经济实力将消失。 再加上像 SARS 这样的生物武器,地球上最大规模的种族灭绝将在几个月内发生。 如果有什么中国应该生产核武器,就像他们的生命取决于它一样。

不,中国的债务与 GDP 的比率与美国和欧洲相同,为 250%。

它的债务 负担 低得多,因为它的经济增长速度是我们的三倍,而且它的债务完全是内部的。

因此,中国的债务负担不到我们的三分之一。

零对冲不是有关中国信息的可靠来源。 它的前提和预测总是错误的。

见上文我对中国债务的评论。

TG

“我记得在国会‘辩论’中国最惠国待遇的时候。 在《纽约时报》的社论中,亨利·基辛格坚持认为,将我们的整个工业基地运送到共产主义中国将是美妙而伟大的,不可能有任何不利因素。”

您确实了解最惠国待遇只是一种非歧视状态,不是吗? 它只是承诺将中国与其他国家一视同仁。 中国也必须像新加坡、日本、韩国、德国、荷兰、法国、英国、意大利等一样对待美国公司,不得歧视。

亨利·基辛格不需要共产主义中国给他钱。 他从想进入中国的美国公司的咨询费中赚了很多钱。 每次访问中国,他都会带着几位CEO陪同。 由于保证基辛格会与领导人会面,因此这些首席执行官将与领导人进行一次美好的合影留念……这将花费他们相当多的咨询费。

可能会很吓人。 很大程度上取决于债务的计价方式(以您自己的货币或外币计价)以及谁将其取出(公共或私人)以及如何使用(仅仅是投机或对材料生产或研发的投资)?

考虑到人口差异,印度的经济实力是美国的一半,这很合理。

但这是在数量上,经济实力也意味着所售商品的种类。 销售价值 1b 美元的计算机芯片的国家肯定会比销售价值 1b 美元的衣服和食品的国家拥有更大的经济影响力吗?

基辛格是犹太人,所以他与叛徒完全相反,他是爱国者 他的 以色列国。

该计划是在美国沦陷之前掠夺美国{不像苏联}。 华尔街和美联储 / 中央银行 / MIC 已经完成了计划——不仅是掠夺美国,而且还利用它作为一种工具来印制尽可能多的钱=数十万亿美元。 这个国家被 100% 破坏,连同任何大笔的美元社会基金 { SS ,住房/城市发展,你能说出它们的名字},以及下一次华尔街/美联储引发的萧条,将从已经干涸的社会中吸走更多的东西。 他们将获得上层中产阶级——下一个。 没有人为社会的任何巨大改善而努力 - 国内或国际 - 政府{联邦,州,市政等}的每个人似乎都在获得他们所能获得的所有金钱和利益。我很抱歉,但我看不到任何积极的未来,直到它崩溃,人们可以击退政府控制者的军队,他们会破坏他们所能破坏的一切——即使是在之后。 这些“所有者”在计划 #1 中得到了他们想要的东西——他们讨厌我们,宁愿消灭我们中的大多数人。 中国眼睁睁地看着一切都在下降,并且正在努力。 俄罗斯也不会哭太多。

他们忘记了?

更严重的是,美国的精英们用金融权力代替了经济权力,因为这样做对他们有利。 他们根本不在乎这个国家其他地方发生了什么。 他们不住在那里。

他们不仅直接从美国的去工业化中受益,而且还想从中国工业增长最终的金融化中受益。 中国人有更好的想法,并将他们排除在交易之外。 美国精英会因此而倒下,但美国中部却受到双重打击。 首先是他们自己的精英,然后是他们的精英未能控制中国人。

当你不注意你中间的叛徒时,就会发生这种情况。

美国中左翼和中右翼都认为中国是对战后“世界秩序”、“全球规范”、“普世自由价值观”等的威胁,今后无论中国经济如何,这都将成为冲突的基础。尺寸。 问题是中国将如何应对这一挑战。

小时候,我曾经以为我们会像日本/韩国一样赚钱,保持自己,但不幸的是,中国的规模引起了更多的关注,使得这种孤立主义站不住脚。 为了长期安全,中共应该尝试使美国强加给世界的自由价值观非正常化,以便非自由民主国家仍然可以被视为合法的,因此值得永久支持,而无需诸如“总有一天他们会像我们一样!”

你明白了,但这些事情需要时间。 另外,要小心你想要什么。 “恢复我们的制造业”需要一代人以上的时间。

一个原因是,在美国工业中心地带建造和工作的人们已经退休或离开了。 必须培养整整一代辛勤工作的男女来管理植物。 谁来抚养他们? 做2代。 与此同时,脱钩对美国人来说意味着一个充满伤害的世界。

它必须完成,所以它会。 问题是如何。

中国成为经济强国的最显着优势是它没有寄生犹太人流血致死。

中国女人很朴素。 那是东西。

是的,愚蠢的白人太多了。

金融是国际化的,犹太人不太可能在中国没有某种控制权,因为首先主张将制造业转移到中国的是犹太人亨利·基辛格。

听起来像是一个中和中国的伟大计划。 中国人也从来不擅长大规模复杂的战争。 汉族人口需要被扑杀……周围那些丑陋的昆虫太多了。

在这方面,美国在技术上领先于中国和其他所有国家(不是像机场这样的基础设施,而是领先的技术)。 它可能会持续一段时间。 没有人会和我们开战。

这不就是白日梦吗? 因为自动化指日可待。

它拥有与我们不同的精英。 他们也变得富有,腐败,但同时做他们的工作,让他们居住的国家变得更好一点。

对不起,我打字很匆忙,没有正确的标点符号。

应该是:根据中国政府统计局的数据,2017 年中国 GDP 为 82.7 万亿元,而不是打错了 127 万亿元。

对 GDP 持怀疑态度并不罕见,在没有详细说明这个问题的情况下,中国的经济数据确实与 GDP/人均 GDP 相似的国家完全一致。

当然,中国总体上是一个贫穷的发展中国家。

虽然视频很短,很容易观看,而且值得一看,但你必须对美国人普遍看法很低,认为我们愚蠢到需要其中相当基本的信息。

虽然今天有很多中国游客回到中国,但也有很多中国人移民,包括非法移民,主要是移民到白人国家——而中国人是美国“生育旅游”行业的主要客户——所以与旅游流相比,移民流仍然几乎是单向的。

我认为绝大多数普通的西方白人都知道中国已经发生了巨大的变化,并且不会嫉妒中国人应得的成功。

虽然我理解您的情绪,但请注意以下几点:

——中国的大部分外来投资并非来自美国。

——劳动密集型产业:大部分从美国转移到中国的制造业属于低附加值性质。 实际上,这种制造业正在转移到越南和孟加拉国等国家。 随意与他们竞争,或者如果以最低工资雇用大量美国裁缝是非常可取的。

最近,此类行业为中国的农民工提供了就业机会,但中国的人口结构发生了变化; 我怀疑,至少在城市里,年轻的中国人对在低薪工厂工作有兴趣。

–核心或中型技术产业:只有汽车产业获得了美国的大量投资。 你可以要求他们无视中国市场并退出。 中国知名度较高的行业之一是美国几乎没有的高铁基础设施。 中国每年的钢铁产量是美国的 8 到 10 倍。

–高科技领域:中国一直受到美国严厉的技术制裁禁运。 再次,您可以要求微软忽略中国市场。

.....................。

当然,与中国脱钩是不够的; 请将墨西哥、加拿大、德国……添加到列表中。

我建议你也应该对那些用机器人取代人类工人的美国企业征收重税。

第一支柱

没有上帝,但没有上帝,中国没有巨无霸,只有无名氏(麝香猫有人吗?)。

第二支柱

出口商、小型出口商……世界联合起来,出口型经济出现了。

第三支柱

进口商#2……好吧,如果第二支柱分崩离析,那么#1 儿子就不会在中国被发现,而是隐藏在众目睽睽之下。

支柱四

请看一个数字和两个数字,然后请找到不可能的四个数字......

除了开玩笑,白人男孩(犹太人和基督徒)不会放弃他们的权力给他们自己的怪物,一旦伊朗问题得到解决以确保黑金,俄罗斯将被贿赂以避开即将到来的对抗中国以台湾为诱饵。

日本和韩国从来没有孤军奋战过赚钱; 就像德国一样,两者都被美国有效占领。 中国有切实的机会至少与美国竞争,成为欧洲的主导因素,但为此你需要一场软实力革命并了解欧洲的心态。 与当前的美国“文化大革命”相比,提供一些吸引人的东西应该不难。 理智、家庭、和平与繁荣都在大和谐中。

谁知道呢,你们百年屈辱的终结也可能终结我们的屈辱。

中国可以有第一的称号。 我在树林的脖子上看到的只是腐烂和腐烂。 让我们停止用绷带包扎自由党腐烂。 美国的无关紧要意味着很多痛苦。 然而,它可以带来急需的清理和恢复的机会。 我们只需要先处理军队的核武器、生物武器和常规武器,就可以肆无忌惮。

向中国致以最美好的祝愿。 你仍然欠罗斯柴尔德银行很多钱。 再加上你有华裔非洲婴儿和他们的妈妈带你去。 永远记住,这一切都与 GDP 和另一个王朝有关。 我希望我有一个泡沫手指送你去路,但你可能做了它们。 我也同意沃尔什先生的观点,友善是我们的长期优势。 我们需要一些对报复和报复不感兴趣的人。

大屠杀

同意。

问题是由谁? 你认为这场悲剧中谁的收获最大?

世界大战 III:乌克兰航班 PS752 西部假旗

远程劫持/转发器禁用触发两枚 Tor-M1 导弹

这是一个 长 计划。

虽然美国已经被伦敦金融城的银行家去工业化; 中国工业化了。 自从肯尼迪遇刺以来,许多总统都参与了这项倡议。

14 年 2020 月 XNUMX 日 中国人民币升值对美国人来说意味着觉醒

Peter Schiff 讨论中国经济、人民币升值以及这对美国消费者和投资者意味着什么——RT America Boom Bust 13 年 2020 月 XNUMX 日。

中国经济——借来的时间!

(在习近平领导下)愚蠢的、反自由的、顽固的共产主义、小平之前的经济政策的回归意味着中国目前正靠借来的时间生活,并且必须在某个时间点崩溃,而且可能很快就会崩溃。

事实:当权者通过自上而下的集中控制措施(即“加倍下注”)对这次崩溃做出的反应越多,经济崩溃的速度就越快,而且越严重。

由于像习之流这样的权力狂妄自大者无法通过教育、历史(例如苏联)甚至直接经验来学习,我预计“中国奇迹”的崩溃将继续有增无减,并且实际上加速,因为中国大陆共产主义经济文盲主持节目实际上是在他们的高度破坏性政策上加倍努力,即更少的经济自由和更严厉的中国人口控制。

请参见:

中国准备迎接 XNUMX 月的诺曼底登陆日:一家大型国有企业的“史无前例”违约:中国的金融体系正开始严重崩溃。

“在我们描述了正在撕裂中国小型银行的自毁式末日循环三天后,中国在短短两周内就发生了第二次银行挤兑——对于一个直到今年早些时候还没有一家银行被允许挤兑的国家来说,这是前所未有的事件。公开失败,今年迄今已发生不少于五次备受瞩目的银行国有化/救助/挤兑——中国债券市场正准备迎接前所未有的冲击:财富 500 强的中国大宗商品交易商有望成为最大和最二十多年来,在美元债券市场违约的最引人注目的国有企业。”:

https://www.zerohedge.com/economics/china-braces-unprecedented-massive-default-state-owned-enterprise

“中国的摩天大楼繁荣在开发商违约的情况下崩溃”

https://www.zerohedge.com/markets/chinas-skyscraper-boom-halted-amid-developer-default

“经济复苏叙事注定失败:Fathom 的中国动能指标预示着更多下行空间”

https://www.zerohedge.com/economics/without-china-global-economy-doomed-brace-downside

此致onebornfree

http://onebornfreesfinancialsafetyreports.blogspot.com/

Godfree……中国的债务是内部债务是的。 但是,更突出的一点是,中国的债务票据存放在其国有银行内。 比较债务的人忽略了金钱固有的“类型和渠道”因素。 他们在比较不同的种类。 苹果和橙子。

在西方,公共和私人债务工具被转售到市场上。 在那里,他们落入了富豪统治的手中。 西方的货币类型与中国不同。

中国有中等水平的私人银行,它们反过来从较大的国有银行借款,而这个中等水平的银行通过推高房价造成了一些损害。 近年来,该州通过阻止贷款将其拉回了一些。

底线:中国有一个以债务为基础的货币体系,但产生人民币的债务工具与西方的渠道不同,这种渠道是一个关键特征。 中国的债务可以被释放,以防止社会两极分化,因为这些债务是在政治控制之下的。 中国的债务不是由憎恨普通公民的掠夺性(((财阀))阶级持有的。 在公共层面(即国有银行)创建的债务工具规定了如何使用新抵押的人民币。 元道(窜)是入公地和业。 这种类型和通道因素意味着新元是有益的,可以改善所有人的命运。 这也意味着中国领导层正在尽职尽责,即使普通中国人不理解。

货币渠道和类型是工业资本主义的关键特征。 我在这里一直在争论中国有一个工业资本主义经济。

以这种方式看待事物有助于人们看得更清楚。 美国和西方已经输给了中国。 西方的寄生虫(((金融类)))在二战中获胜。 一战和二战主要是一场金融资本主义与工业资本主义的经济战争,德国的工业资本主义受到了攻击。 布尔什维主义是金融资本的产物,因此在二战中站在了西方一边。

西方的民主只不过是国家资助的高利贷。 西方掠夺者阶级的新自由主义、新科恩斯主义和虚假经济被消耗殆尽……它可以在世界舞台上制造混乱,拼命争取利润和控制权,但无法召集数以百万计的人和物资对抗中国。 今天的情况不会像二战前那样展开。

不幸的是,西方被锁定在一个不能结束而只能失败的集体信仰体系中。 尤其是美国没有办法与缠在脸上的吸血鬼鱿鱼竞争,吸走不劳而获的收入和租金的命脉。 鱿鱼会导致效率低下,因此购买力会因鱿鱼的掠夺而降低。 这些回扣是看不见的,但它们以高价的形式出现。 我估计它可能高达经济的 40%……这是造成高价格的损失和回扣,这是一种将购买力输送给掠夺者的价格税。

希望俄罗斯逃到一个新的沙皇或拜占庭式的国王系统,然后采用某种主权货币控制。 那么西方人就会有一个逃避高利贷者对他们的大脑空间、政治和生活的影响的例子。

http://www.sovereignmoney.eu

1970 年代初大卫洛克菲勒派他的蝙蝠侠基辛格到中国向 ZUS 开放中国奴隶劳工,然后 ZUS 的去工业化开始,每个 ZUS 大公司都将工厂搬到中国,底线是现代中国是ZUS制造的。

ZUS和中国之间所谓的裂痕完全是胡说八道。

为什么会有人关心普通白人对他们国家的看法? 普通白人现在很可能处于阶梯的最底层,因为他们就像一台效率非常低的机器,也就是说,由于精英白人制造的技术进步,他们要求很多而回报很少 - 他们是与精英犹太人一起做事的人。

也许大规模的 0f 不加思索的白人不会疏忽中国……但他们应该这样做,当西方政客将所有工作岗位运送到那里时,他们国家的整个制造业基地都被摧毁了。

你错误地认为美国不喜欢国家是因为他们缺乏自由民主,美国更愿意与最坏的独裁者和独裁者讨好……只要他们站在同一边。 中央情报局在拉丁美洲安装了许多独裁者。

中国只是威胁美国霸权,民主只是用来为侵略辩护的借口

为什么会有人关心普通白人对他们国家的看法?

我认为 1) 那是视频的目标受众; 毕竟,它在 YouTube 上,任何人都可以观看,并且 2)这就是 Carlton Meyer 将其发布到此处的原因,即普通人会观看它,因此也许会更新他们对中国的看法/看法。

一些美国人足够聪明和成熟,他们意识到美国政客和官僚应对破坏美国就业的贸易立法和政策(以及利用这种情况的企业高管)负责,因此他们不会嫉妒中国人的经济成功——显然你不在这些聪明成熟的人中。

在决定阅读您的评论时,我立即被提醒为什么您在我的 IGNORE 列表中。

笨蛋。

正是。

他们(洛克菲勒)并没有因为任何原因深入沃伦委员会对肯尼迪遇刺事件的掩盖。

像希夫这样的洛贝塔主义者是一个笑声暴动。 他们因错误的想法而获得荣誉犹太人身份。

以下是他在您的视频中的一些评论,这些评论令人难以置信:

短期内是坏事,但从长远来看是好事,因为美国正在走向自给自足,并开始为自己创造东西,任何主权国家都应该这样做。

这将是更典型的 Lol-bertarian 催眠,就好像你需要从外国债权人那里借钱或取钱一样。 美国不需要向任何人借钱,它已经拥有技术和能力的安装基础。 它尤其不需要从中国借回自己的美元,也不需要中国的债务或人民币。

任何主权国家都可以直接向民众发行新资金……然后你就有了一个储蓄池。 或者,任何主权国家都可以解除债务,然后不再将以前的信用作为货币进行销毁,然后您就拥有了储蓄池。 或者,你可以直接从国库发行到工业,并且你不需要中国的钱来建设工业。

Lolbertarians 因其扭曲的思维方式而获得荣誉犹太人身份。

确实如此,但 Lol-bertarians 是私人货币和私人银行的辩护者,美联储就是一个例子。 Lolbertarians是把水壶称为黑色的锅。

请帮自己一个忙,把lol-bertarians调出来,他们是(((mammon)))的名誉代理人。

希夫一直在谈论生活水平。 真正的国家有自己的钱,自己做事,关心自己的人民,靠自己的努力提高生活水平。

任何国家唯一需要外国“资本”的就是购买自己无法制造的东西。 即便如此,借款也必须谨慎行事,这样它购买的新东西才能提高生产力以支付货币利息——这指向外国债权人。

你欠外国人债,你失去了主权; 一个懒惰的人无法理解这些概念。 它们是为了自由市场(没有这样的东西)和自由的,以及在无国界世界中的人员国际流动。

国家破坏者(((国际阴谋集团)))对他们的经纪人希夫非常满意。

关于肯尼迪遇刺案,请阅读 L. Fletcher Prouty 上校的 JFK, CIA and Vietnam 和 Joan Mellen 的 Blood in the Water,这两本书都可以上 amazon.com.

搜索结果

网上精选片段

印度:1984 年至 2024 年按现价计算的国内生产总值(GDP)(十亿美元)

以十亿美元计的国内生产总值

2020* 3,202.18

2019* 2,935.57

2018 2,718.73

2017 2,652.25

还有 37 行•6 年 2019 月 XNUMX 日

https://www.statista.com/www.statista.com › 统计 › 国内生产总值-印度国内生产总值

• 印度1984-2024 年GDP | Statista

大象对龙。

美国是老鹰。

我认为神兽会战胜鹰和象。

人们制作视频来告知,但我的问题是,为什么其他国家的人应该真正关心普通白人的想法? 它们本质上是不相关的。 即使白人对中国持负面看法,中国也会继续做它该做的事,这些普通的白人无能为力。 关心普通白人的想法就像关心普通班图斯的想法一样。

此外,普通白人知道他们自己的肥猫把他们卖掉了,但这并不意味着他们不会愤怒地看待中国,因为聪明的人知道在奸诈的高管把所有工作都运到那里之前,中国只是另一个狗屎国家。

链接到基本语句。

哈佛的格雷厄姆·艾利森不同意 米尔斯海默教授认为,中美之间至少会发生冷战或代理人战争是不可避免的。 但即使是艾莉森也认为有先例。

有趣的是,无论是北约还是苏联,从他们面对的数万辆坦克来看,似乎都不相信核武器是一种威慑力量。 又是怎么回事,'令人难以置信的行动的威胁不是可信的威慑。 苏联人可能总是能够用他们的坦克和他们在管状火炮方面几乎 10:1 的优势横穿铁幕。 核武器是对核战争的威慑。 然而,这样的墨西哥对峙为常规战争留下了可能性。 克里姆林宫知道它无法在全球范围内与世界上最强大的经济体进行的冲突中获胜,而这场冲突将不可避免地发生在对西欧的军事征服之后。

美国将首先尝试减缓中国的增长速度,看看它能否在竞争中胜出。 有这么多中国人,他们的国家超过美国似乎是不可避免的。 如果美国人坐以待毙,中国将拥有一个过于强大的经济体(大而 高级 ) 承担。 随着中国因其庞大的规模而对其邻国更具威胁性,美国将与印度和俄罗斯结盟。 那个时候还没有,但除非美国突然开始超越中国,否则美国的经济战略会失败,动用武力成为唯一的出路。

在全球范围内,中国是净债权人。 想一想:你听说过中国债券吗?

在中国这样一个无菌、现代化的国家,SARS 和所有其他严重传染病是不可能造成许多受害者的。

是的。 我宁愿让我的国家由腐败的工程师管理,也不愿由腐败的律师管理——任何一天!

好片子,看完了。 公理——美国“精英”对全球经济、军事(尤其是军事)和地缘政治平衡一无所知。 甚至(仍然严重不准确,尽管比“名义”好)购买力平价 GDP 数字并不能反映美国“经济”的骇人听闻的现实,它被货币化到了怪诞的规模,而且不仅仅是更小,就实际经济而言,它要小得多比中国经济。 值得注意的是,至少对趋势有所了解的人是美国军方的一些人(可能是情报人员),我称之为相对边缘的经济学家和分析师。 美元全球金融体系的整个纸牌屋就是那个纸牌屋。 原因是维持这个系统的主要工具——(神话)美国军事力量无法维持它,它根本没有资源(人力、技术、知识等)来维持它。 这种虚张声势在几年前被称为,但许多人只是拒绝面对他的事实——他们会的,这是不可避免的。 所以,他们最好开始在南半球的某个地方购买房地产(我相信他们已经这样做了),或者安排一个漂亮的高档精神病房,那里有好护士和好药。

我理解印度教民族主义者期待印度崛起为超级大国的愿望。 印度是一个复杂的国家,很难预测。 让我重复一遍我在这里和那里说过的话:

1)印度最大的问题不是经济增长率。 大规模的失业/就业不足是。

(印度政府的失业数据被高度低估了)

2)印度精英严重缺乏目标优先级意识。

3)印度社会过于精英化。

(我可以添加更多,但让我们停在这里..)

...... ..

印度民族主义者抱怨与中国的贸易逆差。 从中国进口的产品范围从手机到太阳能电池板再到锅碗瓢盆。 印度制造业的工资肯定比中国低很多(而且中国仍然是一个发展中国家)。 他们不能制造更便宜的锅碗瓢盆,是不是很莫名其妙?

中国仍是发展中国家,无意将力量投射到地球的每一个角落。 自1979年以来,中国没有打过任何战争。

世界和平。 马拉纳塔。

大约 50 年前,我在欧洲时就了解了 GDP 的弊端。 在英国,一品脱啤酒(约 2 瓶美国啤酒)的成本约为 8 便士,瓶装啤酒稍贵一些。 当时,英镑在 2 美元的范围内,所以一品脱的成本大约是 1/12 x 2 = 17 美分。 你在哪里可以花 10 美分买到一瓶啤酒? 当时英国的平均工资是每周 15 到 20 英镑,即 30 到 40 美元,或者不到美国的一半。 很明显,在金本位时代,如果一切都以美元计价,即使是英国工资较低的人也与美国工资较高的人一样富裕。

斯堪的纳维亚半岛不同。 一切的成本要高得多,但平均工资比美国高,最高收入者和最低收入者之间的差距比美国更压缩。 因此,虽然成本更高,但与美国相比,低端工资收入者的购买力更强。

浮动汇率只会增加幻想。

好文章错过了更重要的相关点。

1.中国不是一个以战争为基础的经济体,因此美国在F35这样的飞砖上浪费的钱都投资在了基础设施上。 中国的公路、铁路和城市设施使美国看起来像一个第三世界国家。

2. 有100个城市配备了工作5G,每个城市的人口都超过10,000,000万,再加上高就业率,使美国和欧洲看起来几乎是史前时代。 有了这些城市,美国已经输掉了比赛。

3. 中国的教育是重中之重,基础科学学科的标准是世界上最好的。 美国、英国和欧洲的教育主要基于外来主人强加给土著人民的过时的政治正确政策。

还有许多其他的东西,例如基于忠诚、尊重和共同礼仪的家庭道德。 通过货币价值衡量生活并不是唯一或最好的标准。

好文章都一样。

尽管这是一篇很好的文章,但我是否可以恭敬地指出,作者的论点过多地是对中国的宏观经济观察,并且没有反映最近的事实,这些事实使中国继续保持经济霸权的主张受到很大质疑。

尽管作者提出的指标确实支持了他的总体前提,但在提出的主要四点中,我可以添加以下非常简短的对位,用于过去六个月的初步讨论:

1,按购买力平价计算,中国拥有世界上最大的GDP,自2014年XNUMX月以来一直如此。

没错,但是……中国现在正处于经济放缓状态,GDP 从 14.2 年的 2008% 暴跌,并且连续六年每年都下降到 6.15 年目前的 2018%。中国人民银行估计 2019 年和 2020 年将低于这个号码。

2.中国是世界第一大出口国。

没错,但是……正如 2019 月报道的那样,23 年中国对美国的出口下降了 XNUMX%,这也是 MSM/特朗普吹捧贸易逆差下降的原因。

3.中国是世界第二大进口国,拥有第二大零售市场和最大的电子零售市场–上海的CIIE。

没错,但是……中国消费者的购买量正在下降,这体现在汽车销量持续下降,7.5 年和 2019 年分别下降 6% 和 2018%。通用汽车表示,其在中国的销量下降了 15%。

4.中国零售市场与美国大致持平,增长较快。

没错,但是……消费者购买正在下降,中国人民银行上个月采取了几项举措,旨在为经济注入更多流动性,以刺激购买和 GDP。 央行刚刚开始,时隔四年,首次降息。

尽管作者的介绍做得很好并且有根据,但它是一篇沉浸在中国过去成功中的文章,而不是当前的内部现实表明这是另一个即将意识到不可持续债务真相的国家。

然而,我确实喜欢这篇文章。 干杯!! BR-T。

经济因素无关紧要。 随着时间的推移,普通的“受过教育”的美国人将成为“气候变化”、“政治正确性”、“多样性”、“性别研究”、“平等”等方面的专家。

中国人将没有这些,而是受过高等教育的人,他们是科学家、工程师和专家,他们在真正真实和富有成效的事情上。

猜猜谁会赢?

不要混淆锡安的策略和伦敦的“债务扩散”。

他们确实操纵了中国,尤其是在鸦片战争中。 “城市”与中国的贸易不平衡,尤其是白银,所以他们的想法是不择手段地收回他们的钱。 在这种情况下,它是在向中国人的嘴里插入一个药物依赖钩。 当然,犹太人也参与其中……沙宣。 当犯罪公司时,他们总是参与其中。 正在做。

中国从中吸取了教训。 在天门广场之后,他们保留了国有银行。

美国的去工业化主要发生在 1995 年后,当时“国际资本”想对中国劳动力进行工资套利。 中国通过将共产主义时代的债务清扫到垃圾桶来帮助华尔街/伦敦的策略,这样他们就可以满足标准,然后获得贸易,甚至是最惠国待遇。

通过将人民币纳入“货币篮子”,就会降低美元在世界贸易中的相对实力。 那些发行美元(私人银行)和他们的走狗(美国财政部)的人不会这样做,因此反对。

中国的资金大部分是主权的,并通过其 5 家国有银行完全由政府控制。 系统内的任何私人公司银行(中层和下层)最终都处于国家控制之下。 不准私人银行得逞,开始偷窃公共利益。

你不能将国际货币基金组织与中国混为一谈,因为国际货币基金组织是超国家的,而中国则为他们的国家利益而运作。

中国没有不可持续的债务……这是受过新自由主义经济学训练的脑残经济学家做出的可笑断言。

中国的债务是主权债务,由其国有银行持有。 他们可以随时简单地删除它。 中国也可以随时拉动内需,不再需要维持出口模式。

此外,中国正在丝绸之路上获取新的矿产资源资产和能力。

中国人口的能力随着人类劳动效率的提高而增长,同时,他们的工业厂房和设备定期更新到新的状态,他们的公地得到改善。 所有新的铁路和港口都是可见的见证。

中国正在运行工业资本主义的前“美国经济体系”。

与此同时,美国经济学家成了新自由主义经济(从伦敦ZOG进口)被洗脑的傻瓜,只见树木不见森林。 因此,我们不得不忍受对中国不可持续债务的评论。

在墓地前吹口哨并不是一种生存策略。 看清事物的真实面目,是一种生存策略。

我想你可能错了。 虽然中国的城市确实很干净,但更多的农村不是,我是根据经验说的。 维基百科有 2% 的人口在露天排便,而我见过的最糟糕的厕所之一是在中国,它是一个蹲式厕所,地板甚至墙壁上都涂满了粪便!

我认为生物武器会在中国造成大量伤亡,很多人仍然生活在农村和肮脏的环境中。

它们确实存在。 参见,例如:

http://www.chinamoney.com.cn/english/prdbmkcbt/

中美之间的主要贸易争端涉及中国服务业对“外国金融服务”的开放……这是犹太人的委婉说法。 进口真正的中国商品不是问题,因为犹太人有很好的代表,他们的中间商、批发商和零售店每进口一双垃圾人字拖、便宜的太阳镜和耐克黑人靴子都会大手笔砍价……所以从中国过度进口不是问题。 请注意,在最近与中国达成的部分“贸易协议”中,加密货币犹太人特朗普斯坦和他的快乐乐队(Munchkin、Krudlow 等)已获得承诺,允许“外国人”更大程度地渗透中国国内服务业。金融服务”,即犹太人。 用反向抵押贷款、发薪日贷款、1.4 个月汽车贷款、房屋净值贷款、ETF、年金、96% 信用卡、互惠基金、赌场等来射杀 18 亿王和王的想法有 KKK (Kock Kutter Kult)认为它只是重头戏......它有可能统治中国,就像它统治一个畏缩屈从的北美一样。

中国精英造就 *很多* 比美国更好的外交政策/人口决策,这就是为什么他们的国家比美国或西方更安全的原因。

然而,正如你所说,中国经济正在显着放缓,但增长放缓的幅度比你想象的要大得多。

过去 10 年,美国的人均购买力平价增长速度更快,美国人均绝对差距与中国人均绝对差距越来越大。 美国的人均 GDP 比 1990 年还要高。

https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD?locations=US-CN

这是链式美元:

https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.KD?locations=CN-US

当你考虑到极度功能失调的黑人人口时,这个结果变得更加惊人。 美国白人和汉人人均 GDP 的差距远远大于目前所有美国人和所有中国人之间的差距。

问题是美国的经济是迄今为止世界上任何一个大国中最好的,但它的精英却是 *极其* 贪婪,一直为自己囤积所有的钱,一直把它浪费在愚蠢而愚蠢的战争上,把美国的大部分钱都塞进了自己的腰包。

印度也是非常多民族的,因此由于民主和争吵,即使发生了变化,变化也会非常缓慢。 我确实认为莫迪政府正试图将印度教徒和锡克教徒团结成一个身份,尽管牺牲了穆斯林。

中国经济似乎非常集中和平稳运行。 印度经济非常不正规,一切都是家庭手工业,除了一些主要城市,你不会在印度看到沃尔玛类型的商店。 从文化的角度来看,我认为这很好,因为由于跨国公司的进入并破坏了独特性,西方已经不复存在的社区意识仍然存在。

印度最大的问题是种姓制度 IMO,没有精英制度,取而代之的是一个平权行动制度,根据该特定国家的人口统计数据,将政府工作和大学名额以不同比例分配给不同的种姓。 在某些情况下,多达 70% 的名额可以留给那些被认为是“落后种姓”的人,想想美国的大学系统,但在类固醇下,这会导致人才流失,因为有能力移民的人会这样做,而那些不能这样做的人有点搞砸了。

美国似乎也在利用印度作为制衡中国的某种棋子,美国过去与巴基斯坦关系密切,甚至在 1971 年战争期间派遣航母编队前往孟加拉湾支持巴基斯坦人。 巴基斯坦当时就与中国关系良好,但后者只是小土豆,没有人认为这是威胁。 但从那时起,中国已经发展壮大,中巴与 CPEC 等国家的关系也在发展。 美国现在支持印度,避开巴基斯坦。

巴基斯坦人看到他们与实际上正在建设自己的国家 IL 的中国达成了更好的交易,而不是仅仅引发战争向他们出售武器的美国,中央情报局几乎可以肯定他将巴基斯坦归咎于伊斯兰恐怖的温床(更多所以比伊朗)

印度并不是传统意义上的真正的民族国家,它在其存在的 72 年中没有停滞不前是一个奇迹。 不过,我确实想知道他们进入中国的轨道对他们是否有好处。

如果您意识到他的国家不是美国,则不会。

Mefobills(你选择的名字让我的心感到温暖)你很成功。 我认为您在金融/经济学领域有经验吗? 无论如何,你的话打破了围绕西方政体的浓雾,它掩盖了本应显而易见的东西。 我不仅指的是我回复的这篇文章,还指的是同一篇文章中的其他几篇文章。 保持良好的工作!

跨国公司更关心利润而不是国家是从第三世界引进大规模移民的最大罪魁祸首。 如果他们都决定搬出这个国家,我不会流泪。 谷歌、Facebook、苹果、微软、亚马逊,所有我关心的都可以 GTFO。 再见并摆脱困境。 滚出美国,停止在美国出售他们的狗屎。 如果你想在美国销售,不仅要在美国生产,还要雇佣美国公民。 让我们看看他们不能承受更多损失的市场,美国还是中国。

“我觉得奇怪的是,美国白人多么热情地捍卫‘他们的’国家,考虑到它由犹太人和黑人主宰,他们是其中的二等公民,而且年复一年地变得越来越如此。”

是的,那很愚蠢,但我们是一个愚蠢、无知、粗鲁和粗鲁的人。

我是否天真地认为没有发明任何基本技术的文化无法取代基本上发明了一切的文化?

“随着时间的推移,普通的“受过教育”的美国人将成为“气候变化”、“政治正确性”、“多样性”、“性别研究”、“平等”等方面的专家。”

你忘记了'holyhoax'。

林,

您遗漏了前一句和您引用的句子的第一个单词。

“让我们举一个假设的例子来理解这一点。 认为 127年,中国生产了价值2017万亿元的商品和服务。”

请仔细阅读…… ;^)

你就这么容易被这种特殊的伪知识分子愚弄,“我们需要更多的政府干预经济”,共产主义道歉,永无止境的国家主义者 BS 行吗?

好吧,为你感到羞耻! 🤮

“问候” onebornfree

这是一个非常愚蠢的评论。

这是一个真正的威胁。 中国政府如何处理这将决定他们的未来。

这基本上是寄生虫试图锁定新宿主。

中国有自己的寄生精英,他们和犹太人一样无情和肆无忌惮,甚至更多。 唯一的区别是他们不像犹太人那样渴望权力。 不过请放心,他们对中国造成的损害同样巨大。 二十年来,他们一直在偷窃和掠夺自己的人民。 许多人现在正带着他们的不义之财逃到更绿色的牧场,即西方,为了“自由”(在他们因腐败而入狱之前)和“清洁空气”,即使是他们弄脏了空气和空气。河流与他们的高污染工厂开始,或为工厂老板收受贿赂。

一些假设:

https://www.veteranstoday.com/2020/01/14/ps752-downed-by-cyber-attack/

https://www.veteranstoday.com/2020/01/14/boeing-crash-new-full-footage-and-big-riddle-why-canada-is-afraid-for-black-box-secrets/

https://www.gospanews.net/en/2020/01/12/soleimani-killed-boeing-shot-down-isis-exulted-traitors-shadow-inside-irans-pasdaran/

天哪,我是必须培训中国人工作的先锋。 第一家进入中国的美国科技公司。 我亲眼目睹了经济学以及随后对美国工业的破坏。 即使有我的警告,公司管理层仍在破坏性的道路上继续前进。 管理和财务处于错误结构的控制之下,导致它们出现故障。 大多数情况下,它是在大学里学到的训练无能。

于是我承担了学习这个惨淡的职业的任务,以便理解。 正是像 Soddy 和 Douglas 这样的工程师才能了解事物的经济真相。

这个惨淡的职业恰如其名。 高利贷为很多骗局提供资金。

希拉里·克林顿允许中国访问她的电子邮件服务器,该服务器保存着她所做的一切、国务院、所有委员会以及她与克林顿基金会的所有私人事务。

https://truepundit.com/fbi-lisa-page-dimes-out-top-fbi-officials-during-classified-house-testimony-bureau-bosses-covered-up-evidence-china-hacked-hillarys-top-secret-emails/

联邦调查局知道,他们什么也没做。

https://dailycaller.com/2018/07/12/ig-clinton-foreign-emails/?utm_medium=social&utm_source=twitter&utm_campaign=site-share

James Clapper、Peter Strozk、Christopher Wray,整个沼泽都是同谋。 他们知道,什么也没做。 联邦调查局什么也没做。 司法部什么也没做。 你的中央情报局什么也没做。 他们从中国收到了多少钱?

然而你责备俄罗斯并憎恨俄罗斯人。

据《每日电讯报》周一报道,这家总部位于华盛顿特区的中资公司据称将代码插入了克林顿位于纽约州北部的电子邮件服务器,该代码将实时发送该公司几乎所有的电子邮件。 据称,这发生在她担任国务卿期间,直到 2013 年。

然而你把你的问题归咎于俄罗斯。

也许美国真的可以再次伟大,如果它停止了几十年来一直将其切割成碎片的背叛飓风以及政治、经济和军事叛国。

也许那时俄罗斯和美国可以遏制中国。

他们在俄罗斯的大学里作弊一样多,而同一阶层的人却视而不见。

也许这反映了中国在过去10年是一个资本密集型经济体的事实。 在此期间,基础设施建设的比例可能高得不成比例。 一旦中国转变为消费型经济,人均收入和个人消费的增长将开始加速。

问题是,这种差距会持续多久? 近年来,中国人均 PPP 的相对增长似乎较快。 例如,19年中国人均GDP约为美国的2010%,2018年约为29%。 再往前看,1990年中国的人均购买力平价只有美国的4%左右。

最后一根稻草,

也许情况就是这样。 我可以看到它正在发生。 但是,一个国家在发展的初期阶段比在后期阶段发展要容易得多。 这是因为大多数创新/技术是转让的。 中国,除非进行重大改革,否则不会比这更快地增长,而且很可能由于年事已高而放缓。

当然,没有什么是可以预防的,所以对这个分析持怀疑态度,但我的观点是,如果你判断中国和美国在过去十年的经济状况,美国做得更好。 当然,鉴于美国的人口愚蠢和政府的财政不负责任,这很可能在未来结束。

我通常同意这个网站上一些中国观察者的分析,包括 GodFree Roberts,但强烈不同意这一点。

从本质上讲,您的论点是美国的购买力被夸大了,并且是基于虚假价值,并且很快就会消散。 不仅如此,美国的实体经济也远低于目前的估计。

现在如果你说的是真的,那么美国人民从中国得到了价值数万亿美元的消费品,却给了他们毫无意义的美钞作为回报,而他们的实际购买力却大大降低,这就是美国最大的骗局。世界史。 为什么那些明智的中国精英会允许这种情况发生?

不仅如此,考虑到实体经济的大幅下滑,这意味着美国人以很少的投入获得了极高的价值,使他们成为整个地球上最有生产力的人。

现实是,美国经济真的是21万亿美元,中国经济是27万亿美元。 中国的增长速度超过美国,很有可能从美国主导的单极世界变成两极世界。

但声称美国正处于大规模崩溃的边缘是非常值得怀疑的。 像日本这样的停滞是有道理的,它具有更大的去工业化和 *非常* 债务与 GDP 的比率高于美国,但在我看来,崩溃只是一个愚蠢的幻想。

中国人当然拥有缩小差距的资源和能力。

然而,我对此表示怀疑。 从绝对值来说,从底部增长比从顶部增长更容易,所以像中国这样的国家相对而言很容易赶上。

各国总是很容易缩小相对差距,索洛曲线就是他们所说的这种现象。

鉴于中国的人口状况比美国好得多,如果他们现在不缩小绝对差距,那么我认为他们不会很快缩小,因为他们的情况正在迅速恶化。

在军工综合体的无用投资中损失了巨额资金。 与此同时,教育系统仍然过时,泄漏氚的发电厂得不到修复,基础设施、道路、桥梁、水坝正在摇摇欲坠。

美国“输出”的“服务”是否包括:轰炸国家或暗杀将军(战争行为)、以军事入侵威胁国家、通过制裁进行粗暴恐吓? 这些是美国出口的服务吗?

又一篇崇拜中国的文章。

任何经济体建立在盗窃、谎言和扭曲之上的程度,与该经济体在崩溃和烧毁之前的持续时间成反比。 也永远不清楚什么样的东西会点燃保险丝。 由于几乎不可能从谎言中确定真相的百分比,所以当整个事情崩溃时总是令人惊讶。

我的中国预测:预计在未来十年内,由一些非经济事件引发的崩溃和燃烧。 如果中共活下来,中国将是一个大大削弱的“世界大国”。

美国“经济”的现实是FIRE(即产生零实际价值的服务经济)的75%以上,与中国的制造能力相形见绌。 美国在哪些领域至少保留了一些领导力和专业知识,而不是在哪些领域明显落后。 这里有一点“见识”给你。

我建议你熟悉这份提交给 POTUS 的跨机构报告。

https://media.defense.gov/2018/Oct/05/2002048904/-1/-1/1/ASSESSING-AND-STRENGTHENING-THE-MANUFACTURING-AND-DEFENSE-INDUSTRIAL-BASE-AND-SUPPLY-CHAIN-RESILIENCY.PDF

如果您还没有这样做,那么现在是开始的好时机——这是处理认知失调的好入门书。 我敢肯定,你从来没有听说过美国没有真正的商业造船业,而中国却拥有巨大的商业造船业。 见鬼,俄罗斯的商业造船让美国看起来像业余爱好者。 我相信你听说过波音和通用电气,以及它们是如何被杀死的。 除此之外——当然,一切都很美好。 我相信美国律师、文学评论家、保险代理人、房地产经纪人和汽车经销商的大军正在努力制定美国经济复苏的计划。

沃尔什文章的副标题是“美国的无知或否认构成严重危险”

我认为美国人(我是其中之一)深陷否认,或者是无知。 被催眠和堕落的人包围实际上很尴尬。 但是,话又说回来,如果你听到的只是糟糕的叙述,那么你就不会知道更好了。 垃圾进垃圾出。 人类与计算机几乎没有什么不同,除非他们获得新的编程。 好莱坞和自有媒体对美国的大脑空间以及西方世界做了很多工作。 谢谢犹太人。

主要由华尔街领导的美国出售美国的遗产以进行工资套利。 遗产来自过去,包括一个民族国家的知识产权和皇冠上的明珠——包括来之不易的诀窍。 工资套利是工资之间的差值。

(((通常的嫌疑人))认为只有价格重要的人通过偷偷摸摸的卑鄙方法从美国(和其他西方国家)提升工业。

美国工业被金融阶层用绿色邮件技术、做空和彻底的胁迫攻击,去中国拿中国的价格。 此外,还向码头工人和零售业支付了贿赂。 中国商品将在零售视线水平上架,然后取代现有的美国主要街头劳动力。 (劳动使商品成为价格)。

我认为美国经济是建立在谎言、盗窃和扭曲的基础上的。 我实际上并不反对——我知道。 这是大多数美国人不想正视和正视的现实。

大豆男孩和女人受情绪驱动,他们尤其不想面对现实。

任何文明都有等级,西方等级精英是隐藏的。 隐藏的金融精英正在控制事物; 不是为人民工作的政治精英。 恶魔统治的政客不过是袜子木偶。

相比之下,中国拥有一个牢牢掌权的政治阶层。 这个政治阶层使用投票和数据来获得反馈,而不是投票。 中国的政治阶层正在为人民服务。 处理它。

中国使用一种不会“剥夺”其生存权的优质货币,这反过来意味着中国是永久有效的。 如果一个国家的钱被一个掠夺性集团吸走,那么价格必须上涨。 这位美国工人的大脑和背部携带了一种寄生虫。

随着掠夺者金融阶层对美国劳动力的掠夺,与中国劳动力逐年提高相比,已成定局:中国获胜

被华尔街卖掉的遗产被卖掉了几美分。 来之不易的过去今天被出售用于套利。 套利流入华尔街,推动 401K,让华尔街成为英雄……一时间。 但是,未来来了,现在主要街道是 Zeroes,因为如果华尔街的离岸策略从未发生过,他们已经失去了任何潜在的收益。

经济学……尤其是新自由主义的虚假经济并没有编纂时间。 等号无法应对挑战,因此与等号之间的交换不同,等号很猖獗。 遗产的丧失是巨大的损失,一代人的损失。

此外,来自大便世界的棕色人的无限移民导致工资下降,导致经济不安全,并导致边界/文化不安全。 美国人对此投了反对票,但它仍然存在。 你需要更多的证据证明政治课不适合你吗?

这些不安全感没有货币价格。 遗产没有货币价格。 你不可能有一个有凝聚力的民族国家,当这种巨大的骗局持续不断时,一切都打着良好经济的幌子,而事实恰恰相反。 它只对“阶级”的人有好处,其他人的口袋深处都有一只隐藏的手在挤压他们的睾丸。

中国的礼品经济或非货币化经济不以 GDP 数字计算。 但是,我们可以肯定它比美国要大得多,美国几乎完全被金融类货币化了。 美国傻瓜现在只考虑美元,因为他们的大脑空间已被殖民。 然后,这排除了成为人类的其他方面。 美国的退化将继续,因为西方的高利贷制度还没有被取代。

货币价格并不是经济健康的全部和最终目的。 用你的眼睛,不要相信来自 Teevee 的虚假叙述和无知为专家买单。 中国在崛起,美国在衰落。 如果所有的经济收益都通过金融富豪统治,美国经济就不可能再次伟大,而美国经济的大部分都是虚假的金融工程,这反过来又是另一种形式的高利贷。 华尔街不是实体经济。

波音是当今美国的完美类比。 为 MCAS 系统进口的低价值印度劳动力编写代码。 波音高管用新的银行信贷推动他们的股票期权,但没有投资新的工厂和设备(更换 737 而不是重新发动机)。 将总部从西雅图移开,然后从远程位置和从高处发出指示。 财务部门根据 EBITDA 做出决策,好像利息税和折旧前的收益是唯一重要的指标。

这种巨大的恶作剧只能在高利贷流出金融的情况下才能完成,因为任何反标识的东西都是不自然的,不自然的必须有资金才能存在。

为什么中国会担心“债务”? 这是内部事务,主要由政府控制下的国有银行负责。 只要外国账户井然有序,他们就可以用“债务”为所欲为。 这只是虚构的,内部簿记,如果你有能力的话,可以随意创建和取消。 而中国的.gov 拥有这种权力。 这是西方金融专家似乎不理解的事情。

评论者 Mefobills 在他的分析中很到位。

干得好先生。 特别是这个:

只有失败和内战才能唤醒美国。

中国到了顶峰就会倒下,就像现在的美国一样。

现实情况是,GDP 是对交易的统计,交易不会创造财富。 它们充其量反映了一项可能会或可能不会产生财富的活动。 财富当然是用事物来衡量的,如果活动没有产生或帮助产生某些东西,它不会增加财富。

我也怀疑,只要某些条件盛行,大规模崩溃的可能性就会出现。

其中最主要的是美元维持其储备货币角色的能力。 如果这种情况以一种不受控制的方式动摇,那么国际持有的美元数量远远大于国内持有的美元这一事实将意味着随着其国际公用事业的崩溃,大量美元将涌入国内购买任何可以购买的实物资产。

这将恶性通货膨胀置于菜单上,而应对它的唯一方法是实施货币管制,让国际美元像孤儿一样消亡。 无论哪种方式,都会发生内部“大规模崩溃”。 由于无法在国际市场上购买零部件,美国剩余的工厂(实际上只是装配厂)将在几天内关闭。 无法在国际上购买能源(石油、天然气和电力),将进一步导致经济活动大幅下降,因为能源价格将飙升并随之而来的短缺。

我们离美元失去储备地位还有多远? 嗯,国际货币基金组织的最高层正在讨论这个问题,央行被告知要为后美元世界做准备。 事实上,英格兰银行行长马克卡尼最近在杰克逊霍尔就这个话题发表了演讲。 我建议你调查一下。

如果运行世界储备系统的人认为美元作为世界储备货币的消亡是不可避免的,并且公开谈论它,那不仅是不可避免的,而且很有可能迫在眉睫。

尽管如此,美元的消亡肯定不是“愚蠢的幻想”,随之而来的“大规模崩盘”也不是。

伟大的系列帖子 Mefobills。 我本来希望自己打字。

另一个类比是写一系列借条或支票供人们交易,然后有一天每个人都想立即兑现他们的支票,BAM! 你拿着包。

金钱=债务=金钱=债务=金钱=债务

“我们正在偿还你的债务——祝你好运。”

啊,Erebus,通常的chink shill。

如果美国和美洲大陆本身没有因拥有巨大的资源而得天独厚,那你就会有道理。

与出售资源的俄罗斯和中国不同,他们是用金钱(即纸)购买资源,以便自己储存。 金钱(即纸)可以简单地通过信任和暴力来支撑。

美国的崩溃与金钱或资源无关,而与美国社会的死亡和种族冲突/内战有关。 这将导致真正的民族主义者掌权的重生。

它在 1920 年拥有更多的资源。实际上,剩余的资源是悬而未决的果实。 提取困难且昂贵,在某些情况下还严重枯竭。 容易开采的资源消失了,当时推动美国工业化的几乎免费的能源也消失了。

以目前的速度开始使用 1920 年的资源需要多长时间? 提示:4代

毫无疑问,美国会复苏,但这次以目前的速度开始使用剩余的东西需要多长时间?

一代?

二?

三?

在此期间会发生什么?

提示:它被称为“崩溃”。

美国致力于自由主义,无论是专制的还是民主的自由主义都无所谓。 他们支持的独裁者——尽管经常被称为法西斯主义者——在经济上始终是自由的。 像皮诺切特和佛朗哥这样的独裁者并没有过多地参与他们国家的经济,而是向外国(通常是当时的美国)影响开放。 他们通常将经济交给技术官僚来运行。 这就是为什么在佛朗哥死后西班牙如此顺利地过渡到自由民主国家的原因,因为技术官僚们已经种下了自由主义毒药的根源。

这也是美国容忍他们存在的原因,即使他们像佛朗哥一样在社会上保守。

美国在陆地和附近海域(德克萨斯州、加拿大、阿拉斯加)都有大量的石油、煤炭、矿产和天然气,这还不包括南美洲的宝库。

崩溃是可能发生的,如果不改变路线就会发生。 但美国不会懒惰太久,因为如果不是美国人收获这些资源,其他人就会跨海去做。

另外,不,正如所说,美国的资源几乎没有被使用,因为美国更喜欢用钱购买资源。

Erebus,

我同意美元可能会在某个时候失去其储备地位,尽管这种可能性远低于该网站上人们普遍认为的可能性。

但是,我不相信这会导致美国崩溃甚至是持久的问题。 有很多国家的货币崩溃了,有些国家停滞不前,有些国家经济衰退,但没有一个国家崩溃。 委内瑞拉正在接近,但这是由于美国的制裁和工业国有化并没有以委内瑞拉货币崩溃。

我同意中国精英比美国精英更贤能,更胜任,但现实情况是,更糟糕的是美国会停滞不前。 有崩溃的可能,但不比中国或俄罗斯多。 每个发达国家都有这些尾端风险。

题外话。

先生,最近没有看到您的文章。 我非常喜欢你的丰田工厂比较 https://www.unz.com/article/trade-war-iii/ 文章。 你有更多这样的宝石吗?

最好。

是的,基辛格先生没有根据《外国代理人登记法》(FARA)进行登记。

几乎每个人都忽略了储备货币地位是一种惩罚。 美元在贸易中的效用具有溢价。 这 储备金 有效地:

— 补贴每次进口

— 惩罚每次出口

制造业的大量实际工作将是 *已创建* 通过结束美元储备溢价。

和平😇

“1913年中期,英国成为第一个在欧洲推广使用人民币的国家。 德国、法国、瑞士和卢森堡通过安装 OCB 参加比赛,以促进使用“人民货币”(“人民币”)。 ”

预知?

确切地。 将实现某种其他形式的平衡。

大多数人口并不生活在中国农村,人口密度低得多,因此传染病不会传播得那么快。 事实上,城市中心的压倒性密度是主要挑战之一,但它也是更容易控制疾病的地方之一。

你说得有道理。 如果所有的美洲保险公司一夜之间消失,那会是世界末日吗? 或者病人会设法找到医生并付钱给他们吗?

同样,所有美国律师的一夜失踪也不是一件坏事。 更少的法庭案件和更多的非正式定居点。

不,他们有一个很大的优势。 他们的人。 他们很容易受到外界政治天上掉馅饼的影响,但他们似乎有能力从这种越轨行为中恢复过来。

大声笑,你不知道中国佬和他们的偏差。

他们在历史上被野蛮人羞辱是有原因的。

中国王朝的平均有效期最多为200年。

你对历史的理解,就像你对数字的把握一样,是极其贫乏的。 中国两次“输给”野蛮人——第一次是在与蒙古人和女真人进行了令人难以置信的长期战争之后,这些蒙古人基本上压制了其他所有人。 这持续了很短的时间,然后中国人在明朝恢复了自己。

明朝本身将持续近三百年,在此期间几乎无休止地战斗,最终崩溃不是因为任何特殊的“越轨”,而是典型的官僚腐败和低效率,使满族在内部起义削弱了明朝后占了上风。

至于被“羞辱”,中国人实际上是驯服了塔里木盆地,消灭了匈奴,从本质上消灭了蒙古人的身份,并逐渐占领了曾经被草原蛮族占领的土地。 你知道,大小不是凭空而来的。

但我想,你的无知和无能在很多方面都是一种祝福。

你的嘴巴能有多烂? 当然会的。 没有储备货币可以永远存在。 “永远”是一个很长的时间

这里的问题是“迫在眉睫”这个词能否适用于美国的崩溃。 对我来说,在货币崩溃的情况下,“迫在眉睫”意味着在接下来的两个商业周期内。 国际货币基金组织发布的白皮书和中央银行家的讲话表明他们也是如此。 你会如何反驳他们?

哦? 你是说魏玛共和国? 也许津巴布韦? 我会称他们为崩溃。 你会怎么称呼他们?

好吧,我并不是说美国的力量是持久的。 我只是说崩盘的概念被夸大了,我预计美元会软崩盘,这就是我所暗示的。 导致美元崩溃的两个商业周期是可能的,当然在可能的范围内,但它不会导致美国的崩溃。

关于魏玛共和国和津巴布韦,一个国家在军事上被击败并被迫接受可怕的法令,其大部分壮年人口死亡或体弱多病,津巴布韦摆脱了他们所有的聪明人,并真正屠杀了他们经济上成功的人。 美国有严重的问题,但没有像那些纯粹的存在问题。 他们没有崩溃,因为他们的货币失去了力量……

看,我同意上升的中国和停滞不前的美国的概念。 但崩溃的概念只是一个愚蠢的幻想。 如果去工业化程度和债务与 GDP 比率远低于美国的日本没有崩溃,那么美国也不会崩溃。 国家不是比特币,它们不会突然崩溃。 这在现代历史上从未发生过。

顺便说一句,这些论文都没有表明美国崩溃,所以没有一个可以证明你的观点。 事实上,国际货币基金组织估计,美国的人均国内生产总值将继续以比中国更快的速度增长,并且两国之间的差距会扩大……你引用的那些人完全相信我所说的。

他们所说的只是考虑到美国在世界人口和经济中所占的份额正在下降,美元的绝对力量有合理的机会消退,尤其是随着中国总 GDP 的增长。

还有一件事,你应该看看世界银行和国际货币基金组织的这张图表,它表明美国在过去 20 年中增加了与中国的人均差距,而你和每个人都在吹嘘美国的中国的完全阴影:

https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD?locations=US-CN

如果你查看国际货币基金组织对未来的估计,写你论文的人估计美国将继续扩大与中国的差距。

由于美国仅占世界人口的 4%,因此美元当然不会永远占据主导地位。 新加坡的货币也是如此,它只享有中等实力,但按人均计算,新加坡是世界上最成功和最富有的国家。 那里也没有崩溃。

你们混淆了一个智商为 105 的国家在获得中等收入方面取得了一定的成功,而许多智商较低的国家却达到了更高的高度,并说这是 4-D 国际象棋的结果。 你们把中国的增长从低于非洲标准的水平发展到宜居,推断增长率,并假设中国将超过世界上所有的发达国家。 坦率地说,这看起来很荒谬。

正如主流媒体是狂热的中国熊一样,你们是狂热的中国公牛。 我认为中国将成为主导的经济强国,但美国不会崩溃或任何废话。 中国也不会超过美国的生活水平,尽管再过 50 年,按人均计算,它可能赶上并超过美国,一切皆有可能。

请记住,美国的治理体系允许其自始至终都生活在技术前沿,而中国则如此即兴发挥,2000 年来一直处于马尔萨斯式的边缘。 我不会很快将美国排除在外。

与中国的几乎所有事情一样,重要的问题是,什么时候?

如果您不指定看到不喜欢的事物的日期,那么我会假设您看到的是古老而贫穷的中国。

别忘了早在 19 世纪 XNUMX 年代中期,黛安·范斯坦 (Dianne Feinstein) 的丈夫理查德·布鲁姆 (Richard Blum) 就与中国人谈判。 我敢肯定,像他这样的人还有很多。

很简单:如果您想在行业中直接获得信贷,请使用类似 Mefobill 的设备。 汇票是三方,并注明付款人、收款人和付款人。

(Schacht 从 33-34 年开始在德国使用 Mefobills 和 Oeffa bills 来做我上面所说的事情。但你知道 - 由于纳粹和其他催眠,我们无法研究国家社会主义。)

基本上,你创造新的购买力并将其指向工业,然后检查账单以确保生产新的商品和服务。 如果生产了新的商品和服务,则允许对账单进行贴现。 折扣是兑换的一个花哨的词。

不知何故,我发现自己是为数不多的知道如何将未来货币化的人之一? 这是为什么? 我不是在吹牛——这更像是一个关于人们对金钱是多么无知的悲哀评论……而这种无知延伸到了那些应该更了解的人身上。

一旦你建立了你的工业基础设施,你就可以使用道格拉斯社会信用来解释机器人和自动化生产。

通过这种方式,您最终将获得一流的基础设施、训练有素的人口以及这些人口手中的钱来购买自动化和熟练劳动力生产的产品。

商品的价格与劳动力购买其产出的能力之间一直存在差距。

自两次世界大战以来,我们(人类)就知道差距理论。 高利贷为欺骗买单,所以经济学家没有被教导现实。 他们训练有素,因此无法回答像您这样复杂的问题。

如果您的财政和货币政策都正确,则无需担心自动化的未来。

坏处:新自由主义的财阀以高利贷为生,他们无意放弃对金钱的控制。 可能需要用力才能将他们的手指从权力的杠杆上撬开。

自由之树需要浇水。

那张图表很容易误导人。 去 彭博,并追踪图中标有“大多数中国人仍然比普通美国人穷得多”的线条,那么您将清楚地看到中国如何缩小与美国的人均 GDP 差距。请注意,彭博社的图表实际上与您链接的图表,除了它显示了美国人均 GDP 与中国人均 GDP 的比率。

我不确定你指的是哪个国际货币基金组织的估计,因为正如我上面指出的,在我看来,中国正在无情地缩小与美国的人均 GDP 差距

我认为中国不会超越任何人。 但它也不会很快停止以每年 5-6% 的速度增长。

XNUMX年来,西方一直走在科技前沿。 美国是欧洲人建立的。 中国没有这样的运气。 另一方面,如果中国勉强活了两千多年,就有点难以想象中国是怎么做到的了。 世界上持续时间最长的文明. 两百五十年在中国历史上是一个相对较短的时期,在此期间的停滞似乎是一种反常。 我认为中国将在未来 30-50 年内赶上西方并恢复其历史常态。

中国人没有逼着枪口冒牌大叔投资,

是美国提出“夫妻”,

您有权随时解耦。

但是你正在做的是强迫一个 全球化 与中国脱钩,

贸易战旨在引发外国产业撤离中国,这种情况已经在发生。

主要的推力是扼杀'中国制造2030'在萌芽状态。

我听说 [[[他们]]] 正在考虑修改“美国制造的 25% 法律”,以禁止任何国家销售具有 10% 或更多美国内容 到中国。

这是在之前的所有恶作剧都未能做到之后,最近一次扼杀华为的尝试。

在关键的芯片行业,[[[他们]]] 正在迫使荷兰停止向中国供应芯片制造机器,事实上,台湾的台积电,世界上最大的芯片工厂,正面临越来越大的压力,停止与大陆开展业务.

对乌克兰也施加了极端压力,以阻止向中国出售喷气发动机技术,等等等等……。

这些只是冰山一角。

甚至中国在非洲、亚洲和太平洋地区的基础设施项目,如铁路、机场、电力、港口等,也正在遭到破坏和脱轨,被暗杀者或其附庸,如 Oz、Jp、印度……

这简直就是一个 全球排华法案 从华盛顿口授。

这个 21C murkkan 咒语,

如果你无法竞争,那就杀掉!@#$%^& !!!

PS

不要让我开始西藏,新疆,香港,SCS,TW,ECS…………

世界银行的数据并没有说明你认为他们在说什么。

(我相信我不久前曾提请您注意这些数字,因此我对它们非常熟悉。)

你应该关注的是 比 中美人均GDP。 1990年,美国人的平均财富是中国普通居民的24倍。 到 2018 年,该比率已降至 3.4。 中国的追赶速度非常快。

如果你只减去当年的人均GDP,得出我所说的当年的“绝对差距”,你可能会误以为美国和中国之间的差距正在扩大。 那是因为绝对差距最初是如此之大,以至于中国必须以惊人的速度增长才能防止差距看起来扩大。 (如果你想要数学,下面的注释应该会让你满意。)

当你引用绝对差距时,你基本上是在声称中国没有每年 100% 增长,你在浪费每个人的时间。 当然,中国没有这样做——没有人这样做。

所以 显著 结论是,中美之间的差距实际上是在缩小,而不是在扩大。

-

那些想看一些简单数学的人请注意。

对于给定的年份,令 U 为美国数字,C 为对应的中国数字。 根据世界银行的数据,在 1990 年,这些数字分别为 U=23,888.60 美元和 C=987.64 美元。 因此,U=24*C,大约(其中“*”表示“乘”)。

现在让 Ug 是 1990 年美国的增长率,而 Cg 是当年中国的增长率。 那么为了缩小绝对差距,我们想要

>>> U*Ug – C*Cg < U – C

(其中“>>>”标记了一个等式。)回想一下 U=24*C。 因此我们想要

>>> 24*C*Ug – C*Cg < 24*C – C = 23*C 。

在整个过程中除以 C(这是因为 C 是正数):

>>> 24*Ug – Cg 24*Ug – 23

or

>>> Cg > 24*Ug – 23 。

如果美国仅增长 24%,我们需要 Cg > 1.01*23 – 1.24 = XNUMX。

也就是说,中国必须增长 124% 才能防止绝对差距扩大。

如果美国增长 24%,我们需要 Cg > 1.03*23 – 1.72 = XNUMX。

中国必须增长 172% 才能防止绝对差距扩大。

当你声称中国没有达到这些不可能的增长率时,你并没有说太多。 就像说地球上没有一个跳高运动员可以在没有帮助的情况下跳出 40 英尺——这是真的,但那又怎样?

中国的历史很复杂,但可以概括为两个阶段:

– 宋前:无休止的内战和亲属纷争。

——宋后:四面八方的野蛮人无尽的屈辱。

即使是像唐明这样的好时代也发生了巨大的内战,明朝的后半部分被太监统治,糟糕透顶,以至于边境将军打开了满族入侵的大门。

具有讽刺意味的是,中国领土最大的时代是汉人被蒙古人(元)和满人(清)统治的时候。 此外,匈奴、女真被蒙古人有效地击败和吸收,而不是被中国人民吸收。 这也延伸到宋元时期的西夏、大理和殷国等各个王国,这些王国现在只是无聊的中国省份。 很高兴越南和日本抵制了蒙古人。

我同意你的一些观点,但我认为你在这里遗漏了一些东西。 每个人都缩小了与更富裕国家的相对差距,这就是数字的结果。

第一个国家不会以指数因素增长,这正是他们增长的特点。 请记住,正如我在另一条帖子中指出的那样,由于中国不断改革,其增长实际上因改革而加速,但由于其基数高于 1990 年甚至 2000 年,它看起来正在放缓。 中国人很高兴中国经济每年使工资和人均 GDP 增加 1000+,然后像 100 年代一样增加 90+,即使这种增长被描述为更高。 中国的发展速度比 90 年代快,但由于基数低,被认为在 90 年代比现在发展得更快。

一个处于技术前沿的国家实际上更难发展,这就是为什么你所依据的指数论点毫无意义,否则任何国家都不可能赶上。 中国增加一美元比英国容易得多,英国增加一美元也比美国容易。 这就是技术转让的运作方式。 这就是为什么像日本这样人口增长率低的发达国家每年增长大约 0.1%,而非洲国家保持每年大约 10.9% 的增长。

你的观点的数学暗示是,发达国家比不发达国家更容易增长,这将验证如果美国增长大约 3-4%,中国就不可能缩小差距的论点。 但这不是它的工作原理,他们甚至称其为 Solows Curve。

如果你真的看一下我展示的世界银行统计数据,中国实际上已经与日本、法国、英国和意大利在绝对值上趋同。 因此,正如您所说,这是很有可能的,并非不可能。 美国只是一个经济强国,这就是差距越来越大的原因。 如果你比较新加坡和中国,你会发现一个已经缩小了相对差距,但在缩小绝对差距方面却毫无进展。

感谢您花时间回复我的评论。

林先生的错误推理。

印度可怜的理发师可以轻松购买比“美国人”更多的低成本印度食品

平等的服务提供者(如理发师)用他收入的 XNUMX% 或 XNUMX% 表示“美国人”。

当然,印度的问题不在于理发师,而在于次大陆 60% 的贫困人口。

但印度以每年 5% 或 5.5% 的速度持续增长,而例外论者每天在他们的统计数据和每一项电视新闻服务中全面使用 LIE。

错误。

1)唐是中国扩张最远的时代,包括南亚大部分地区并延伸到中亚。

2)女真人只是因为中国的干预才被蒙古人打败。 孤立无援地,宋正在慢慢击败晋,并且确实由于纯粹的宫廷政治而放弃了重新夺回中国的机会。

3)元/蒙古王朝是如此短暂以至于几乎无关紧要,他们在1279年取得了最终胜利,1356年红巾军崛起,1356年建立了明朝。元朝持续了不到80年,他们的残余被消灭了出并添加到中国。

https://en.wikipedia.org/wiki/Ming_conquest_of_Yunnan

4)明朝特别鄙视太监,洪武帝企图彻底消灭太监。 他们永远不会控制法庭; 明代问题来自不同的出处。

5)明朝在他们的时代战斗了三百年,几乎都取得了胜利(显然,他们继续存在)。 他们干预了临津战争并击败了日本,并且不断地镇压蒙古人,以至于满族人应运而生——本质上是蒙古人、女真人和其他草原人的统一残余,他们最终征服了一个因内乱而削弱的明朝。

满语现在被彻底消灭了,以至于中国通过支付最后剩余的津贴来努力保持语言的活力。

总而言之:你是非常非常非常错误的。 关于一切。 对于像你这样愚蠢的人来说,这可能是一件好事,因为它可以防止你伤害任何有价值的东西(它伤害了你自己,但你显然一文不值)。

我的原始声明:

这里我说的是生产成本。 有没有想过为什么穆里卡是最大的食品出口国?

(而且它也被称为价格的百分比,印度谷物比美国的补贴更多。当然还有在印度销售的散装谷物的状态/质量问题)

老实说,我不确定您将 5% 的穆里坎理发师收入与 30% 的印度理发师收入进行比较有什么意义。 一名穆里坎理发师的 5% 收入可以购买大量印度人消费很少的肉类。 印度理发师 30% 的收入将主要花在谷物和一些豆类上。

正如我之前所说,PPP GDP 存在不考虑消费模式的问题。 印度或穆里卡哪个国家的价格更低:

—汽油、鸡胸肉、笔记本电脑、

——家政工薪,服务“提供者”……

(BicMac 指数可能不合适,因为印度的 BicMac 是鸡肉三明治,比牛肉三明治便宜)

我不认为你说的任何东西改变了我说的任何东西。

唐境与元、清都不相近。

宋仍为蛮夷所辱。

明朝仍被蛮夷所辱。

所谓内乱,是因为皇帝腐败,朝廷腐败,太监作秀,从秦到清,每一个朝代的结局都是如此。

具有讽刺意味的是,当北亚人的身体比中国人更有威严和强壮时,你称蒙古人为懦夫。

老兄别再叫他们中国佬了。 你可以在不诉诸这种粗俗的情况下进行辩论。

无论如何,正如我所指出的,在过去的 2000 年里,中国是世界上最贫穷的人,这就是为什么他们一直承受着马尔萨斯式的情报压力。

因此,尽管他们拥有世界上最大的经济体,但这仅仅是因为他们拥有迄今为止世界上最多的人口,这就解释了为什么他们在与野蛮人打交道时遇到了这么多麻烦。 但到了 18 世纪,一旦人口压力开始减弱,野蛮人就彻底被中国人打败了。

并且基本上在俄罗斯和中国之间根除。

好像不是很有帮助,是吗?

不言自明的胡说八道。 直到 1300 年代,中国的人均 GDP 一直高于英国。

https://voxeu.org/article/japan-and-great-divergence-725-1874

不言而喻,一个人不会仅仅因为贫穷而获得高人口和有组织的国家; 高死亡率将消除损失。 贫困和婴儿道德之间的脱节只是最近才出现的。

准确的是,中国在维持中央集权政府方面存在巨大的组织问题。 这样的困难产生了一致的后果,与其说是“坏皇帝”,不如说是一个持续内讧和脾气暴躁的朝廷(它变得像在临津战争期间一样糟糕,元素会当面欺骗皇帝,使他很难做出任何决定)。

如果皇帝是太宗那样的天才,那一切都很好。 对于其他人来说,皇帝要么被逼到永乐帝那样的暴虐手段——这进一步激怒了他的朝廷,要么更加不满; 或者皇帝(特别是如果他不倾向于残暴的话)基本上会放弃并“罢工”,例如万历皇帝,他基本上不再对战争以外的任何事情进行统治,显然认为放牧猫不在工作描述中.

由此产生的一个根本问题是,后朝征税困难。 尤其是明朝一直在苦苦挣扎,因为任何大规模的税收努力都受到地方权力的阻碍。 与英国内战中的查尔斯国王类似,皇室根本没有很好的融资方式,它不会受到那些想要削弱对他们的中央集权的人的压倒性负担和限制。 一些皇帝,如洪武,通过保持朝廷简朴并期望官吏接受荣誉而不是财富来克服这一点——但这只会让他们更容易受到腐败的怀疑。

最终没有找到好的解决方案,不断的战争和干预耗尽了国库; 最终,这种压力会导致王朝的垮台。 这不是因为人口特别贫困,而是因为腐败和规模问题没有得到解决。

现代技术的这种集中化问题大不相同。 地方权力拥有这样的权力的概念现在很难想象。

你的愿望就是我的命令: https://www.unz.com/article/what-were-we-thinking/

自 21 年以来,中国国家控制的银行系统创造了 2009 万亿美元的新资金。这比日本、欧盟和美国的总和还要多。 中国债务中有很大一部分是不良债务,经济中充斥着大量亏损的公司。

中国正处于一个巨大的泡沫中,将出现硬着陆。 他们可能会成为我一生中排名第一的力量,但如果没有一场巨大的经济危机,他们就无法度过这十年。

丹尼尔,

这些数字与历史现实和安格斯麦迪逊自己的估计有很大不同。 他是这些问题上的总理。 看看他的网站。 与其在链接中仅引用英国前 1000 广告的一个数字时说我所有的东西都是胡说八道,不如去看看这方面的主要人物,他拥有关于这个主题的最全面的数据。

根据他掌握的数据,中国人是地球上最贫穷的人之一。 不仅如此,人口越多,人均收入往往越高,这表明大量中国人经历了其他任何地方都看不到的可怕贫困。

http://www.ggdc.net/maddison/oriindex.htm

罗恩甚至写了一篇关于中国人选拔压力的文章,如果他们比英国人更富有,这将如何运作?

他们不会崩溃,而是会像日本人一样停滞不前,他们遵循了那条确切的道路,但不会再过 12 到 15 年。

那好吧。 安格斯的这些数字也不是很准确,所以我想我所说的也可以算作猜测。 但我的一个批评是,在你们的数量中,中国处于财富截止点,作者认为这是现代发展大约 600 年所必需的,但从未出现过前进的道路。 这真的有多大可能? 中国人真的很聪明,所以似乎不太可能。

尽管如此,还是感谢您的评论。

什么历史现实? 游客表示中国富有。

当马可波罗在 1295 年回到欧洲时,他对中国(国泰)作为世界上最大、最富有和人口最多的土地的描述并没有被他的许多同时代人所相信。 虽然他的事实描述逐渐获得了可信度,但他那个时代和很久以后的欧洲人继续怀有对神秘和异国情调的东方的信仰。

XNUMX 世纪早期欧洲对中国的记述主要由葡萄牙商人编写,他们强调中国社会的物质财富、技术技能和复杂的组织结构。

等等。贬义的评论是关于中国人缺乏勇气,而不是他们的贫穷。

这也是 剑桥核心阅读器:

将中国的这些结果置于国际比较框架中,可以为大分流的时间点提供新的线索。 我们的估计表明,北宋中国在 1090 年左右比末日英国更富有,但英国在 1400 年已经赶上了。

选择和挑选一个随机作者并不会使其更有效。

我对 Clark-Unz 选择理论很熟悉,你可以自己查一下。

https://www.theamericanconservative.com/articles/how-social-darwinism-made-modern-china-248/

显然,它不需要贫穷。 进化不是这样运作的。 选择只需要在繁殖中选择一个特征。 它只是要求文人有更多的孩子。

其中特别提到中国的农业技术是在19世纪才落后的。

中国的农耕方式一直以来都异常高效,但到了 19 世纪,中国人口的持续增长终于赶上并超过了现有技术和经济结构下农耕制度的绝对马尔萨斯承载能力

事实上,这样做的美妙之处在于你可以在这里问 Unz 本人,他几乎肯定会不同意你对历史的非常可疑的评估。

首先,马可波罗走访了中国最富裕的地区,也是人口最多的地区,并假设现实在其他地方都是一样的,这显然不是现实。

虽然 Angus Maddison 的统计数据并不完美,但比你列出的要好得多,而且在过去 2000 年的大部分时间里,中国的整体发展水平处于中低水平,低于其他亚洲国家,甚至拉丁美洲国家美国社会。

甚至统计数据 *你发布了* 马可波罗访华期间,意大利的发展水平远高于中国。 依靠与您的基本数据相冲突的轶事很难让您的图像在这里看起来更好。 马可波罗显然是在用一种宏大的方式说话,而且由于中国人显然是聪明的人,所以他们最富有的地区是一些发展中的一个是有道理的。 但是,根据您自己的数据,意大利的发展标准比中国高 50 年,因此要么马可波罗像蝙蝠一样失明,要么像大多数欧洲作家倾向于做的那样,他用夸大的话说话。 此外,从那个时期开始,中国将损失大约一半的人均国内生产总值,因此马可波罗的观察与此无关。

关于 Clark-Unz 论文的观点,我不同意你的说法。 选择只有在贫困存在的情况下才有效,否则将不会选择任何东西。 在世界上每一个社会,穷人的孩子都比富人多。 唯一一次相反的情况会发生,如果贫困的形式足以迅速使穷人的婚姻和未来前景变得致命,这就是当代中国所发生的事情。 如果中国比英国富裕,这就是你所说的,那么为什么在过去的 1000 到 2000 年中国发生了极端选择,而在英国早期却没有?

我知道 Ron 向 Peter Frost 提到中国的选拔压力是 *非常* 比英国的选择压力更大,即使在那时,英国也是高度密集的。 如果它比中国穷,那么它几乎肯定会承受同样的选择压力。

我感觉你认为我在侮辱这里的中国人,而我非常尊重他们。 但事实是,考虑到中国极端的人口密度,以及中国这么大的国家的人均 GDP 较低的事实,这解释了为什么野蛮人能够在北部边境造成如此大的破坏。 在 1800 年代,中国的人口压力消退,经济发展到顶峰,最终彻底消灭了蛮族。 中国经济的所有框架都承认它在1830年达到顶峰,与宋朝同在,中国人在世界经济中占有最大的份额。 这就是你的数据所展示的,也是所有教科书所说的。 所以我真的很困惑你想在这里争论什么。

对不起,我说的是清朝而不是宋朝。

好吧,他们中的数以百万计的人还生活在蒙古、中国北部和俄罗斯的一部分地区。

不过要小心满足你的嗜血欲望,否则你可能会惹恼你的俄罗斯支持者。

到 2020 年,中国现在的债务负担是美国的三分之一。

上周,高盛高级银行家贝丝·哈马克 (Beth Hammack) 曾担任美国政府咨询小组美国国债咨询委员会主席,他向财政部长史蒂文·姆努钦 (Steven Mnuchin) 发送了一封信,信中底部有一个重磅炸弹。

根据 TBAC 的计算,未来十年美国将需要出售令人瞠目结舌的 12 万亿美元债券,比过去 10 年要多得多。

哈马克女士警告说,这将“对财政部构成独特的挑战”,即使“不考虑经济衰退的可能性”。

用简单的英语,委员会中的华尔街名人在问,到底谁——或全球金融界——会购买这座迫在眉睫的美国国债?

鉴于姆努钦正前往北京进行另一轮美中贸易谈判,这个问题非常及时,如果不是讽刺的话。

近几十年来,中国一直是美国债务需求的可靠来源,因为该国积累了大量的防御性外汇储备,其出口繁荣使其有美元可投资。

但现在正在发生转变:去年 1.18 月至 1.12 月期间,中国持有的美国国债从 1.25 吨降至 XNUMX 吨,远低于三年前的水平,当时中国持有的美国国债超过 XNUMX 吨。 ——吉莉安·泰特,金融时报。

一个国家的货币实现和维持国际储备货币地位的基础不能仅仅归结为统计数据。 它们既是政治的,也是经济的。

美元的储备地位有 3 个方面:

– 世界上最大的经济体。 规模和产量很重要……

- 世界上最强大的军队。 规模和能力很重要……

– 一个深入、透明且运行良好的财务/税务系统。 规模和政治信任很重要。

今天这些都不成立,因此美元的储备地位是在惯性的烟雾中运行的。

事实上,没有一个国家可以三足鼎立并取代它的位置,这是继续保持其现状的主要“支持”。 没有从美元过渡的机制,也没有什么可以过渡的。 一旦找到解决方案,美元的储备地位就会动摇。

美元和美元现在没有任何 3 条腿的支持是公认的,因此很多人正在研究货币篮子和掉期、特别提款权和各种数字货币计划以寻找解决方案。 大概是希望在外部事件将问题吹得天花乱坠之前找到解决方案,中国现在在支持美元储备地位方面所做的工作比美国自己要多。

中国的辅助但重要的支持来自所谓的“网络效应”,即美元作为交换和价值储存单位渗透到世界各地。 作为全球最大的贸易国,中国在国际贸易中对美元的接受和使用对其维持至关重要。

仅在纸币(又名:实物纸质 FRN)中,总计 $250B 中约有 $375B 在海外流通。 总计 6.2 吨的 UST 纸币中有 16.1 吨由外国人持有,主要是中央银行。 因此,美元享有的另一个支撑是外国人持有大量美元。 中国可以毫不犹豫地断掉剩余的 1.1T 美元,但肯尼亚、津巴布韦、巴西或任何被国际货币基金组织条约强制持有美元的发展中国家可以断掉其外汇储备而不陷入混乱吗? 不。

没有人喜欢混乱,尤其是中国。 然而,如果美国继续在政治和金融上表现不端,其观点有望转变为“必要时混乱,但不一定混乱”。 从那里到“让它燃烧”仅一步之遥。

那些中国人永远是你的大哥。

总是。

是的,美国正迅速走向财政危机。 日本和大多数欧洲国家也是如此。 这与当前的问题没有多大关系:近年来,中国的银行系统所积累的资金是世界其他地区总和的两倍,而且大部分资金都进行了非生产性投资。 您的其他来源具有误导性。 我们已经看到这种“直升机撒钱”策略在历史上一次又一次地发挥作用。 中国没有什么特别的。

中国将首先发生某种金融危机。 这反过来可能会使其他国家陷入危机,但它将在中国开始。

根据我对中国历史的了解,你是对的。

北汉中国人非常高,男性 6 英尺 5 女性身高 6 英尺或更高。

我们西方人认为汉人是矮小的,因为数百年来侨民都是来自南方的小个子中国人。 差异可能是北方人吃高蛋白小麦南方人吃低蛋白大米造成的。 我不知道,不管为什么。

1850年广州太平天国叛军被击败后,最大的侨民来自中国南方的广州? 认为所有汉人都是小广东人,就像认为所有欧洲人都是高个子的俄罗斯人或矮个子的西西里人一样。

我不认为蒙古人与汉人相比有那么大。

从历史上看,中国人是非常民族主义的民族主义沙文主义者,不希望被较小的品种污染。 再加上中国这么大,从来不需要征服邻国。 中国基本上拥有一个国家需要的一切。 我对它了解不多。 但我的印象是,中国一直只是防御性的。 中国在可能的情况下击退了入侵者,但不需要在地理上征服和扩张。

汉人最终推翻了满人。

如果你只关注人均 GDP 之间的绝对差距,你就会错过全局。 要充分了解差距的相对影响,你必须考虑到中国的人均GDP。 例如,如果中国的人均 GDP 为 40,000 美元,那么与假设中国的人均 GDP 为 20,000 美元相比,80,000 美元的差距将产生更大的相对影响。 一旦你把中国的人均GDP考虑在内,你就会发现差距实际上是缩小了,而不是扩大了。

至于与美国或新加坡接轨,以3-4倍的速度(经济增长和中国货币升值的综合影响)增长,中国的人均GDP接近前两者在数学上是可以肯定的。 坚持不这样做对我来说听起来不合逻辑。

……如果中国这么穷,他们为什么可以拒绝马可波罗的提议? 后来英国人呢? 中国不是对丝绸贸易感兴趣,对鸦片绝对不感兴趣。

…如果中国如此不发达,为什么那里的犯罪率低于西方? 当然,一些香港赌场是黑社会的潜伏之地,但总的来说,中国并没有受到街头暴力的困扰,也没有像美国甚至英国这样的帮派出没。

…为什么在 1997 年英国人离开后香港有所改善? 香港当然有政治动荡,但所谓“狂野东方”的贫穷和无法无天在香港已不复存在。

……为什么中国的腐败不如菲律宾甚至美国? 我并不是说腐败不存在,但它不像马尼拉或洛杉矶那样猖獗。

…为什么中国比底特律或洛杉矶更安全?

…为什么中国的无家可归者比美国少?

您是否有任何事实来支持您的陈述,或者您只是记得福克斯新闻?

我听说美国正在衰落,而中国正在崛起……

但是你不能放一个 非常好 男人久违了,

世界第一'屎搅拌器' 已开启 康力龙 最近…。

香港的暴力色彩革命。

“五个骗子”联合抹黑“中国间谍”

奥兹和 TW..'

以上结合帮助华盛顿的婊子蔡银文

在预选赛中大获全胜。

华盛顿计划将台湾所谓的 Amerkkan 研究所“升级”为“大使馆”地位,然后派驻大使。

这是中国宣布的红线,

加大对新疆的抹黑运动。

在 SCS 中火上浇油……

无数小规模冲突押注越南和中华人民共和国,

现在,即使是迄今为止与中国没有领土争端的中立国印度尼西亚也加入了这场战斗.

中国猪流感几乎消灭了国内猪肉供应,

现在,一场神秘的类似SARS的流行病正在武汉蔓延,

现在你知道为什么中华人民共和国正在建设它的海军,就像没有明天一样,

谢谢推荐的两本书。

谢谢你的评论; 许多有效点。

然而,我不明白锡安在这里的相关性。 锡安是由管理这座城市的人创建的,但这是另一个讨论。 我提到的“长期计划”只是关于伦敦金融城。 是这座城市造就了美国,现在却把它拿下。 历史似乎在中国重演。 我对基辛格在中国长达十年的介入持谨慎态度。 就在最近,他又见到了习。

是的,我通常会更接近您在这些问题上的立场。

我不是这些历史经济比较方面的专家,但我的印象是,传统的共识观点是,普通欧洲人的生活水平在 18 世纪末左右才明显领先于中国,尽管有显然,这两个地区存在巨大的地理差异。

例如,大约七八年前,我读了肯尼斯·彭慕兰(Kenneth Pomeranz)的《大分流》(The Great Divergence,2000),我觉得这本书印象深刻,当然也支持这个观点。 Pomeranz 还提供了一个看似有说服力的分析,说明欧洲对美洲的成功殖民化如何成为欧洲后来经济崛起的关键因素。

然而,去年在这个网站上有一个非常长的帖子,其中一些评论者对欧洲何时超过中国提出了争议,其中一位声称最近的学术研究表明,经济/技术的交叉实际上已经发生了大约一个世纪早些时候,可能在 1700 左右。

坦率地说,所有这些人似乎都比我知识渊博,所以对这个问题感兴趣的人可能只想回顾一下辩论并自己决定:

https://www.unz.com/article/why-harvard-is-right-to-discriminate-against-asians/?showcomments#comment-3465250

(我不确定麦迪逊的具体资料来源,但我的印象是,由于他的经济表涵盖了整个世界和过去一千年左右,它们在特定地区的可靠性往往比领先学者的分析要低得多。专家。但也许我弄错了。)

我也想推荐这些,前军情六处军官约翰科尔曼的 300 委员会和前摩萨德维克多奥斯特洛夫斯基的欺骗方式和上校 L.弗莱彻普劳蒂的秘密团队,我有这些书,他们可以在 amazon.com.

感谢那。 我读了前两个,但没有读到最后一个(看起来很棒)。

中国银行体系现在超过 40.1 万亿美元。 超过 37% *全球的* 国内生产总值。 你所有的分析要么是在掩饰,要么是错误地计算了历史上前所未有的国家控制的中国银行系统资产负债表扩张。 通货紧缩的违约危机已成定局。

是的,美国已经过度扩张并面临问题。 这也不是迫在眉睫的问题。 这是中国银行系统的疯狂。

是的,但更大并不一定意味着更好。

事实上,一只老虎可以被一群猴子拆散。

北方的“汉族”基本上是混杂着蒙古人、女真人和北亚人的杂种狗,这就解释了为什么他们看起来与南方汉人非常不同,而且也更强壮。

中国确实试图征服和附庸其邻国,如韩国或越南。 在这种情况下,韩国基本上是中国的狗,而越南则一次又一次地击败中国。 与此同时,日本离得太远了,尽管(当时)拥有亚洲最好的海军,但中国甚至没有希望入侵日本(蒙古人当然尝试了非常可疑的结果)。

具有讽刺意味的是,正是蒙古人及其焚烧强奸的战术摧毁了西夏和大理,才给了中国如此巨大的领土。

你只看分类帐的一侧。

是的,负债增加了,但中国的银行资产超过了负债。

通货紧缩的违约危机已成蛋糕?

1990年。中国经济停滞不前。 经济学家

1996年。中国经济将面临硬着陆。 经济学家

1998年。中国经济增长缓慢的危险时期。 经济学家

1999。中国经济硬着陆的可能性。 加拿大银行

2000年。中国的货币举动使硬着陆风险棺材陷入困境。 芝加哥论坛报

2001。在中国的硬着陆。 威尔班克斯,史密斯和托马斯

2002年。中国寻求经济软着陆。 威彻斯特大学

2003年。银行危机危及中国。 纽约时报

2004年。中国的大败亡? 经济学家

2005。《中国硬着陆的风险》。 努里尔·鲁比尼(Nouriel Roubini)

2006年。中国能否实现软着陆? 国际经济

2007年。中国能否避免硬着陆? 时间

2008.中国的硬着陆? 福布斯

2009。中国的硬着陆。 中国必须找到一种复苏的方法。 运势

2010年:硬着陆来到中国。 努里尔·鲁比尼(Nouriel Roubini)

2011年:中国的硬着陆比您想像的要紧密。 商业内幕

2012年:《中国经济新闻:硬着陆》。 美国利益

2013年:中国的硬着陆。 零对冲

2014。在中国的硬着陆。 CNBC

2015年。恭喜,您获得了中国的硬着陆。 福布斯

2016年。中国的硬着陆迫在眉睫。 经济学家

2017.中国经济会崩溃吗? 国家利益

2018.中国即将到来的金融危机。 每日清算。

2019年中国经济放缓:我们应该多担心? 英国广播公司

他们也对苏联说同样的话。

然后繁荣,有一天苏联内爆。

这不是关于变得更大或更好。

你要么遵循祖先的儒家传统,向长辈致敬,要么唾弃祖先所代表的一切,并与野蛮人分道扬镳。

但话又说回来,看到你的把手,我想我知道你已经选择了哪一边。

我的长辈和祖先是越南人,我跟随他们。

对他们来说,中国佬就是入侵者。

当石油价格暴跌并且他们无法提高产量时,苏联解体了。 当传统油田在 1970 年代初达到顶峰时,美国的生活质量指标趋于平缓。

在很大程度上,中国的崛起是基于他们大规模增加煤炭开采的能力。 他们现在煤炭用完了。 我认为高峰是几年前。 它可能是“现在”。

如果没有人为的廉价煤电,中国在现代全球经济中的贡献并不多。 (美国也是如此,因为完全虚假的水力压裂热潮消失了。)

嗯,美国和中国都是全球化的消费主义混蛋,带有制造文化,所以我不会错过它们。

我只是希望欧洲和亚洲不会受到太大影响。 没有人会错过说唱音乐和廉价的塑料垃圾。

美国愚蠢的工会和懒惰的工人与中国工人

南加州,

我的同情,你从你的特工橙色受损的长老和祖先那里继承了基因。

在越南战争期间,地球上没有哪个国家在 VN 上造成的死亡人数比美国大佬和盟军还多。

你的长辈和祖先是虚假的越南民族主义者,他们非常绝望地逃到了那些在他们的祖国轰炸/毒死了fuck的国家

好吧,这不像是共产主义中国给了他们任何东西,是吗?

以菲律宾为例。 中国要为毒品战争负责,所有企业都归中国出生的大亨所有,美国必须捐赠食物和援助,而所有的钱都要回到中国。

中国永远不会为任何人做任何人道主义事情。 非洲也类似。 黑人难民涌入欧洲,而中国开采非洲珍贵矿产。

然后,当当地人偶尔发生骚乱时——他们会很快再次在非洲发生,因为黑人不是低 T 悠闲的马来人——华人会责怪美国。

Aheum……你到底是怎么得出这个结果的? 在我的书中,127/6.37 给出 19.94,而不是 11.97。

“越南一次又一次打败中国”……几个世纪以来,越南一直是中国的一部分。 出于所有意图和目的——他们是“南方中国人”——这就是为什么不知道的人会认为广西和越南的人是一样的。 在许多情况下——他们是同一个种族。 法国的殖民改变了越南。 但即便如此——他们也向他们所谓的讨厌的“中国”邻居寻求帮助。 清朝确实代表他们与法国人作战。 他们没有驱逐法国人,因为他们已经很弱(尽管他们确实赢得了一些战斗)。 这种关系比仇恨要复杂得多。

真的怀疑美国佬在 1000 年的华人占领中的压迫得分最高,然后在此之上每年的华人入侵。

对不起,但越南人不是你对抗美国佬的炮灰。 在越南出生和长大,我们都记得 1979 年。

问题:——如果有的话,有多少毒品钱去了中国? 我敢肯定,中国政府会很乐意帮助 pinoy 政府解决这种毒品洗钱问题。 我个人不认为中国以外的晚期“华人”是中国人。 最近一位美国驻中国大使是“种族”中国人,我怀疑中国是否有人认为他是亲戚。

中国在非洲开采矿产,如果 1) 非洲人的商品按市场价格支付 2) 对生态问题的关注不亚于在非洲经营的西方合作社 3) 为非洲基础设施项目提供软贷款

我很同情你处于这种对抗的精神状态。

橙剂绝对是一种令人费解和令人上瘾的药物。

为了减轻你的痛苦,你应该争取再次越南入侵老挝。

https://en.wikipedia.org/wiki/North_Vietnamese_invasion_of_Laos

据住在我宿务区的一名华裔菲律宾毒贩说,这一切都“回到台湾实验室”。

这个特别的华裔菲律宾人是一个从不接触毒品的赌博成瘾者。 我对冰毒交易很好奇,就问他。

但是,您在供应链中会产生费用。 进口商、供应商、分销商。 在菲律宾当地。 但大部分钱最终都回到了台湾。 不是中国大陆。 工厂在台湾。

.

你越南狗屎是东南亚最激进的人。 问问你的邻居,泰国人,柬埔寨人,老挝人他们对越南的看法。 1979年的入侵是当之无愧的。 越南一直在不断地在跨境游说RPG,而中国一直在告诉越南停止,但无济于事。 这是入侵的原因之一(还有其他地缘政治原因)。 告诉你的国家不要胡说八道。 它有效。 在短暂的入侵之后,越南得到了响亮而清晰的信息,沿袭至今的边界恢复了和平与宁静。

入侵是完全有道理的。 正如邓小平所说,“有时如果孩子不守规矩,你就得打他们。”

是的,负债增加了,但中国的银行资产超过了负债。

天无绝人之路,

大多数人无法理解复式分类账机制,其中有抵消的负债和资产。

这是一个陌生的概念,需要一些时间才能掌握。 经济学家并不真正了解银行业务和复式分类账。 英格兰银行发布了一份关于银行债务如何创造银行信贷的白皮书,然后才停止了内讧。 BOE 白皮书展示了账本机制的工作原理。 大多数经济学家认为银行业是中介货币而不是创造/毁灭。

所以,如果所谓的受过教育的人弄错了,那么我们必须对外行人放轻松。

正是金融资本主义犹太人(Sephardim)通过操纵阿姆斯特丹的股票市场而致富,然后操纵英格兰银行成立。

1694 年,第一家债务分散银行 BOE 成立。

来自阿姆斯特丹的Goldmen承诺X数量的黄金,并且还承诺英国Goldmen在银行的股票。 当然,来自阿姆斯特丹的犹太人搞砸了英国人。

后来,罗斯柴尔德把爪子伸进了京东方,控制权进一步巩固到了犹太人的手中。

在 1800 年代后期,罗斯柴尔德在第一次犹太复国主义会议上加入了锡安。 实际上,锡安是国际金融资本。 锡安是几千年前犹太人和高利贷方法的直系后裔。

债务传播和高利贷是锡安的家族企业。

当锡安从阿姆斯特丹跳到伦敦时,它以伦敦为家。 然后它试图在随后的几年中感染美国,最终在 1912 年取得胜利。ZOG 现在包括英语圈。

1912 年的选举是由银行资助的事件,美国公众被金钱势力欺骗和操纵。

这座城市并没有提出美国。 亨利克莱的美国经济体系从 1869 年到 1912 年有效。这两种经济体系大多是相互交战的,即工业资本与“国际”金融资本。 1812 年的战争是伦敦第一次尝试在他们的控制下建立一家银行(或者更确切地说是对他们失败的惩罚)。

基辛格只是对中国的强权政治进行三角测量。

听华尔街名人的声音是自杀的。

财政部必须配备政府经济学家,而不是华尔街的旋转门。

这群新自由主义经济学家的旋转门没有答案。 他们陷入了错误的范式。

财政部将不得不发行无债务资金来取消到期的旧 TBills。 没有债务的要么是对大陆有利的主权美元,要么是对外流通的另一种美元。

此外,返回的海外美元必须转换为这种新形式的货币,因此他们无法购买美国资产。 我们称它们为欧洲美元。 不要为了金钱的虚假身份而出卖你的遗产,然后为你的后代搞砸未来。

整个“储备货币”的想法和允许世界其他地方使用美国的钱是一个巨大的错误。 随着海外美元交易区的崩溃,随着外国银行停止使用美元作为储备,世界市场上的盈余美元将希望流向唯一可以兑换美元的地方……大陆。

它甚至不是美国的钱,而是联邦储备券,私人公司银行的债券发行。

要克服即将到来的风暴,需要良好的治理和法律修改,而华尔街的豺狼不掌管法律。 那是留给人民的。 让我们陷入困境的是同一批金融界人士,他们没有能力让我们摆脱困境。

华尔街经济学家甚至不知道货币就是法律,将货币转换为新类型的概念在他们一百万年后都不会出现。

链接到可靠来源?

为什么? 谁将要求贷款? 中国人有很多债务,但几乎所有债务都完全是内部问题。 也就是说,一个中国实体将其人民币借给其他中国实体,这些实体可能会将其资金借给更小的实体,以此类推。 为了启动这个过程,中国政府凭空创造了几万亿元人民币,将它们交给了大型国有银行,并不急于把钱拿回来。 那么谁会要求贷款呢?

当然,很少有国家可以通过创造大量货币来安全地提高经济增长率。 新货币刺激了对自然资源、制成品等的需求。 如果这个国家在这些东西上几乎不能自给自足,它就需要从其他地方进口它们,以换取出口,或者在美国的情况下,用外国商品换取石油美元。 如果该国需要进口但不能进口,那么新资金只会引发国内通胀。 幸运的是,中国有很多方法可以支付进口费用。

中国是少数几个仍然可以快速增长而几乎不需要从国外借款的国家之一。 中国并没有陷入债务陷阱。

嗯,这只是共产主义的团结,coomie老挝正在寻求越南的帮助,所以越南提供了帮助。 说老coomie也得到了中国的支持,所以我猜越南有罪,中国也有罪。

@DB库珀

是的,越南如此咄咄逼人,以至于它不得不忍受每年的缝隙入侵。 还好他们每次都被打屁股。

不管政府怎么说,老挝人和柬埔寨人对越南人的评价也很高。

我们在 1979 年打得很好,考虑到 Pol Pot(中国和美国的盟友)被废黜,而中国军队被越南民兵殴打后最终离开(实际的 NVA 在柬埔寨很忙,废黜波尔布特)。

再次来到越南,再次得到你当之无愧的巴掌。

咦?

你想引用一个比特工橙色婴儿的命运和数以百万计的死亡更复杂的政治网络来证明你的观点吗? 你只是精神错乱。

我在网上交流的老挝人热情地憎恨越南人。

嗯? 你的胸部怦怦直跳真的显示了你的不安全感

越南从来不是中国的一部分。 越南被中国殖民。

是的,越南一次又一次地击败中国。 清朝对法国人做了蠢事。

美国的 GDP 大部分是由热空气制成的,就像它的金融系统来回交易一样,没有任何价值输出。 美国生产多少? 美国的小木屋要花 1 万美元,而这 1 万美元可以让你在像中国这样的地方买一座砖房。 虽然美国在有用的数字中增加了 1 万美元的 GDP 产出。现在有了脚蹼,你在那里有 3 万美元。价值 400 亿美元的俄罗斯 S2.5 相当于沙特支付了 20 亿美元的美国系统。它做的更少但他们的确为此付出了代价因为..他们肯定没有为它工作..让它的价值只有某人愿意支付的价格..所以就像垄断资金购买昂贵的毫无价值的垃圾一样,这一切都增加了 GDP 数字..

与中国的全面战争变得不可想象。 合作对于让两国都生活在繁荣中是必要的。 但美国背负着需要支持的无用包袱。 把没用的人算作美国国民是不公平的。 出于对中国友好和平等的需要,美国必须卸下那些令人眼花缭乱、拖累其经济的东西。 两个国家的繁荣都必须站起来被统计,受压迫的人必须被扔到公共汽车下。

事实上,你如此坚持表达你对“中国佬”的厌恶,这暴露了你对他们的巨大不满和不安全感。 每次你发布一些关于中国或中国人的无耻和刻薄的话,你都会不自觉地表现出自己的软弱和无能。

俗话说:“抗议太多”

他们没有黑人或西班牙裔。

我到底是怎么精神错乱的? 中方还支持老老实说,很挣扎,难道中方也有罪吗?

此外,老挝和柬埔寨在这里有很多越南人。 中国可能会购买政府,但老挝-柬埔寨-越南之间的团结依然存在。

@伽马射线

事实上,你对 chink 这个词很反感,这让我很开心,chink。

SoCal,你的言辞如此愚蠢

不言自明。 我不是唯一一个有这种印象的人

我认为没有错。

正如我所说的许多老挝人,柬埔寨人没有那种热情

相反,我会改写它:

猜猜看,越南多年来一直从中国进口电力,而不仅仅是最近。

请注意,越南是印度支那东海岸的一块土地。 越南北部海岸线距离中国海南岛不到 400 公里。 越南中部完全在海南400公里以内。

你知道越南是怎么形成的吗???

如果你不知道越南向清朝要求——并得到——帮助驱逐法国人,你显然是非常非常无知的。 他们成功与否不是问题。 但我知道有些人更喜欢无知。

你是对的…… 除了购买力平价——当你衡量“实体经济”与“金融经济”时——中国的规模与美国经济的对比变得更加明显。 中国的研发和军费开支也是如此……以美元计算,中国的研发几乎与美国持平……但因为一美元在中国走得更远——我们现在看到的事情并不奇怪。 军事明智——你提出了一个关于 S400 的好观点。 所有军费开支也是如此。 比较一艘中国全新驱逐舰的成本与一艘美国驱逐舰的成本。 作为美国纳税人——这让我头疼……不是因为“恐惧”……而是因为我的钱被浪费了。

嗯,我不能说我知道你说的现在的情况,但如果你回顾历史——台湾在日本殖民时期有一个药厂的历史。 那是日本的主要赚钱机构之一。 当然,大多数有组织的犯罪分子逃离了中共,最终来到了香港和台湾——因此他们与毒品交易有联系……值得注意的是——在“美国航空”中情局的运动中——一些国民党官兵被“困”在金三角从鸦片贸易中赚大钱。 当然,这笔钱是用来对抗共产党的,而美国则视而不见(但我们知道毒贩不喜欢放弃有利可图的球拍)。 最后一部分在《中国之手》一书中,但前中央情报局

我不是在每一篇与中国有关的文章的评论中都出现“叮这个和那个”的垃圾邮件的人。 很明显,你很暴躁,很没有安全感,真是个可悲的人。

我也不是中国人😉

我们大多数人来这里争论、辩论、说服、说服或学习。 “史密斯”的行为表明没有上述愿望。 他的明显目的是激怒、侮辱和挑衅。

再加上他一直在宣传他的“越南人”种族,即使没有人问,也没有一点兴趣,我们可能可以推断出他作为付费巨魔的更深层次的使命:在中国人和越南人之间传播仇恨和冲突。

此外,他的句柄可能与多人一起使用(由于写作风格的细微变化),并且可以使用不同的名称切换。 他不知道也不关心这些信息揭示了什么。 在一个例子中,“史密斯”声称自己在巴西。 在另一个方面,他保护白人免受玻利维亚对印第奥的入侵。 显然不是一个很聪明也很细心的人。

感谢您的提醒,我以前没有意识到这些事实。

当然,这是真的; 在所有真正重要的经济措施上,中国已经超过了美国。 除了美元仍然是第一的事实。 1 全球货币——这是唯一能让美国人在这一点上保持当前生活方式的东西。

唐纳德特朗普正在经历一场贸易战的动议,因为他向他的选民承诺了一场。 但不会有任何结果,因为美国和中国都知道:

1)如果没有廉价的中国进口商品,美国的国内制造能力太少,无法自立,以及

2) 中国拥有如此多的以美元计价的资产,以至于美国经济崩溃也会导致其经济崩溃。

https://www.twilightpatriot.com/2019/09/nobody-will-win-trade-war.html

因此,现状将暂时持续下去,因为尽管中国的经济产出比美国高(考虑到它的人口是美国的 4 倍,这并不奇怪), 都 各国的经济运行严重依赖对方。

不同意。

中国持有的约 1.1T 美元储备约占中国人民银行 35T 美元官方储备总额的 3.1%。 然而,至少在过去的十年里,非正式的中国一直在用双手购买黄金。 在大多数情况下,这些黄金并没有出现在中国人民银行的分类账上。

虽然不知道他们持有多少“非货币”黄金,但基于黄金进口和交易数据的可靠估计表明,数量可能高达 20kT。 If 因此,通过将非货币黄金转移到官方储备中来取代他们崩溃的美元持有量将是一些分类账的问题。

在这种情况下,人们可以预期黄金价格会大幅上涨,但即使以目前的黄金价格,美元明天也可能会暴涨,对中国央行的储备持有量影响不大。 由于美国吸收了约 18% 的中国出口,如果该贸易随着美元一起爆炸,中国的经济活动肯定会受到打击。 中国经济很可能会陷入衰退,但离崩溃还有很长的路要走。

中国的出口市场现在如此多元化,其国内经济如此强劲,其货币互换协议足够广泛,以至于崩溃将比美元的消亡需要更多的时间。

它到底有多傻? 所以你说越南不利于“入侵”老挝,而中国也支持同样要求越南入侵的老挝运动? 不,我认为你不知道越南对老挝和柬埔寨的影响。

中国和越南贸易广泛,中国和日本、中国和美国也是如此。 我猜中国应该停止说美国和日本的狗屎,美国和日本应该停止说中国的狗屎? 不,问题存在,政治正确解决不了任何问题。

是的,越南是沿海的一小块土地,它一次又一次地反击了中国的入侵。 直到今天,中国人甚至不敢再次入侵越南,他们只能占领海洋和岛屿。

@showmethereal

越南是由越南人组成的。 中国历史对你有不同的教导吗?

是的,越南问清朝,事实上,阮朝选择像清朝一样孤立自己,而令人惊讶的是,清朝作为一个腐败的狗屎坑,对法国人无能为力。 不,就在你面前,越南向清朝寻求帮助的事实不是这里的问题,当时清朝无法自保,更不用说越南了。

@伽马射线:

好吧,布鲁夫,听起来你有点痴迷。

你可以成为一个精神上的裂缝。

中国 40 万亿美元的银行系统吸取了风险教训……

21年2019月XNUMX日– http://www.bloomberg.com › 新闻 › 文章 › china-s-40-trillion-banking-s…

如果某些中国价值观和社会学理解以正确的方式包装起来,这个国家的保守派就会吞噬它。 我认为它永远不会被妥善包装,这样做可能会违反我们各自国家领导人之间的君子协定,但这里有很多人在智力上淹没在平等主义的狂欢中,迫切需要呼吸氧气,它可能会大受欢迎。

每个文化左翼的美国人都应该有机会在中国生活并被告知,“哈,哈! 上世纪 70 年代,我们这里也有所有这些主义。 这很有趣,但没有人真正相信它。”

当我注意到 Zerohedge 让 Gordon Chang 作为中国问题的定期撰稿人时,我认为 Zerohedge 不值得我花时间。 接下来我遇到了这个 https://www.bloomberg.com/news/articles/2020-02-01/zero-hedge-permanently-suspended-from-twitter-for-harassment 好的,Zerohedge 出来了!

“与游客流相比,移民流仍然几乎是单向的。”

请记住,中国早就修好了墙,不希望西方人,或任何非中国人住在那里(我认为在中国生活的白人不超过200万,如果那样的话,而且大部分都嫁给了中国人)。 这就是移民流动是单向的主要原因。 在美国,这将被称为种族主义——因为与世界其他大部分地区不同的是,尽管存在本土主义,但美国是一个移民国家,或“法律而非男性”(即任何特定种族或宗教的人)的国家)。 与几乎所有亚洲国家一样,中国是纯粹的“血与土”

然而,想想这个世界上最大的经济体,欧盟拥有世界上最富有、最大和最有前途的经济体。 诚然,它由几个国家组成,但如果有更多的合作,欧洲将成为迄今为止地球上最大的经济强国,拥有最自由的人民。 不幸的是,美国多年来一直以其外交政策阻碍欧洲。 美国精英与欧洲玩的“均势”政治游戏与英国早先所做的一样。 中国虽然名义上永远是一个经济强国,但与一个完全统一和自由的欧洲相比,将显得相形见绌。

看看典型的美国教室。 这让人很难堪。 现在看看典型的中文教室。 这些孩子尊重他们的老师,渴望学习,表现出色。 中文教师是他们社会中能干和受人尊敬的成员。 在美国,优秀的老师会受到学生、家长和行政部门的嘲笑和虐待。

哪个国家有未来? 哪个没有?